EU rules require large companies and listed companies to publish regular reports on the social and environmental risks they face, and on how their activities impact people and the environment. The Corporate Sustainability Reporting Directive (CSRD), which entered into force in January 2023, modernises and strengthens the rules concerning the social and environmental information that companies have to report. A broader set of large companies, as well as listed SMEs, will now be required to report on sustainability. Some non-EU companies will also have to report if they generate over EUR 150 million on the EU market.

The new rules will ensure that investors and other stakeholders have access to the information they need to assess the impact of companies on people and the environment and for investors to assess financial risks and opportunities arising from climate change and other sustainability issues. Finally, reporting costs will be reduced for companies over the medium to long term by harmonising the information to be provided. The first companies will have to apply the new rules for the first time in the 2024 financial year, for reports published in 2025.

The CSRD has far-reaching consequences, mainly for large organisations that have not yet been required to report on non-financial information, but also for smaller organisations that are part of the value chain of these large organisations.

Below is a summary of the most important changes compared to the current commitments.

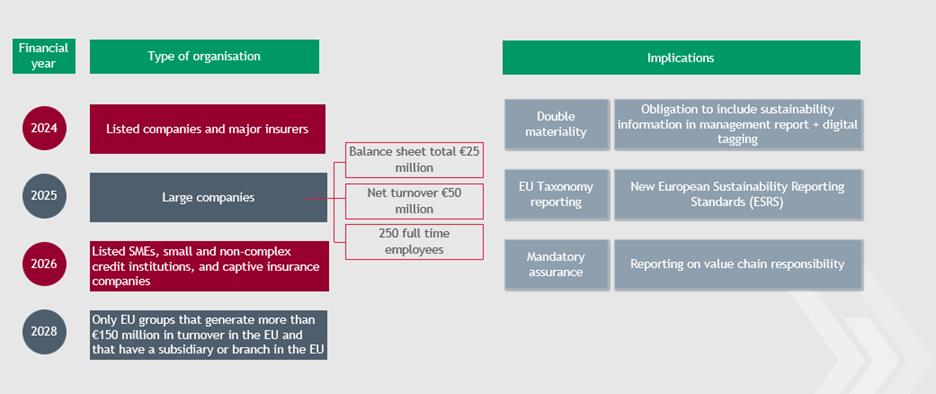

Expansion of the number of companies with sustainability reporting obligations

For large, listed PIE institutions with more than 500 employees (which must already comply with the Non-Financial Reporting Directive), the obligation will apply from financial year 2024. For large companies (which meet at least two of the following criteria at 1 January 2025:

- balance sheet total up to €25 million

- net turnover up to €50 million, and/or

- up to 250 employees

For small and medium-sized listed companies, small and non-complex credit institutions, and captive insurance companies, the obligation will only apply from financial year 2026. For non-EU groups that generate more than €150 million in turnover in the EU and that have a subsidiary or branch in the EU, it will become mandatory from financial year 2028.

Content of the required sustainability information to be reported has been expanded

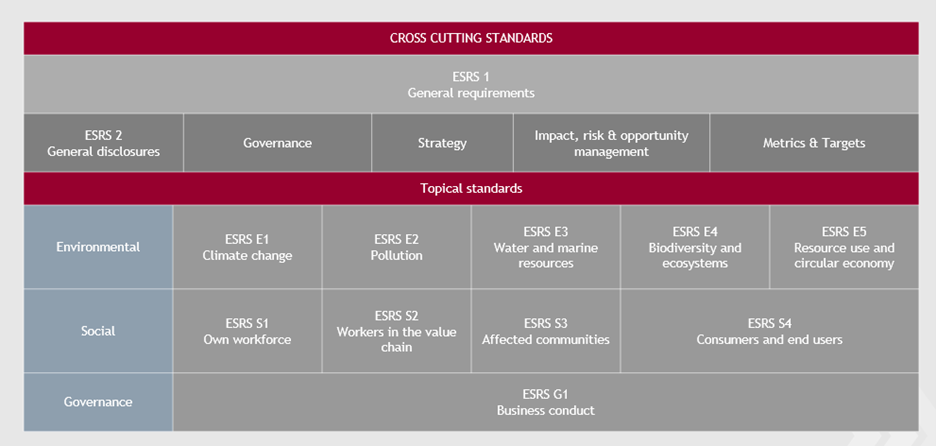

The CSRD prescribes, among other things, the European Sustainability Reporting Standards (ESRS). The standards are outlined below:

There are two general standards, namely ESRS 1 (General Requirements) and ESRS 2 (General Disclosures). The disclosure requirements of ESRS 2 are mandatory for all companies. In addition, there are 10 subject standards that are divided into environmental, social and governance themes. Companies only have to report the disclosure requirements for these 10 standards if this subject is material to them. For each standard, reporting must be done in the following areas: governance (GOV), strategy (SBM), impact, risk and opportunity management (IRO) and metrics and targets (MT).

Mandatory assurance

Under the CSRD, there is an obligation to ensure the reliability of sustainability reporting and thus a limited degree of assurance will have to be obtained in the annual report. This may later lead to an obligation to obtain reasonable assurance in sustainability reporting.

Sustainability information part of the management report and subject to 'digital tagging' (XBRL)

Companies must digitally tag reported sustainability information in accordance with a digital taxonomy, which will help users quickly locate the information they need.

Double materiality

The CSRD standards introduce the concept of double materiality which provides criteria for determining what sustainability information should be included in the company's report. 'Double' refers to both the potential financial effect on the company as a result of sustainability risks and opportunities (= financial materiality, from the outside in), and the impact of the company on people and planet (= impact materiality, from the inside out).

Value chain

The standards call for extensive attention to be paid to the responsibility of all companies in the value chain. This means that companies must report not only on their own performance on ESG themes, but also on that of their clients (downstream) and suppliers (upstream).

How to report in accordance with the CSRD guidelines

To draw up a CSRD report, organisations need to start with their organisational strategy and ambitions. This illustrates the process that organisations go through up to the preparation of a sustainability report and the assurance on this report. This journey typically consists of the steps strategy, design, implementation and reporting.

What can BDO do for you?

BDO helps organisations with the appointment of a responsible officer in this area, information about the relevant sustainability criteria, the quality of the data and finally the preparation and publication of the report.

Would you like to know more about the directive, where to get started with you reporting or do you have any other questions?