How a battle over chips changes the risk landscape for Telecoms

How a battle over chips changes the risk landscape for Telecoms

While not as widely reported as the Suez Canal blockage, a March fire at the Renesas Electronics chip plant in Japan sent similar shockwaves through supply chains. As the flames subsided, car manufacturers, in particular, were busy trying to calculate the economic fallout.

While not as widely reported as the Suez Canal blockage, a March fire at the Renesas Electronics chip plant in Japan sent similar shockwaves through supply chains. As the flames subsided, car manufacturers, in particular, were busy trying to calculate the economic fallout.

Renesas is a major supplier of computer chips, especially to the automotive industry. Modern vehicles are as reliant on silicon as they are to fuel in order to function – a fact that extends to almost every new car, van, or truck.

The link to telecoms and their current situation may not immediately be clear. After all, what is the similarity between Audi and AT&T, or Tesla and Deutsche Telekom? The answer is chips.

Telecoms’ solutions and offerings, from 5G infrastructure to providing modems to customers, rely on computer chips. Since modems are essential to offerings like quad-play, telecoms’ short-term ability to sign up new customers can be severely impacted by shortages. The same dynamic applies to the roll-out of 5G networks.

With analysts predicting that the global shortage could last well into 2022, industries reliant on complex supply chains and large quantities of silicon chips may need to re-think their business operations and supply chains.

For telecoms, this issue arises as other challenges, such as changes to regulation and trade disputes, also need to be considered when addressing a changing risk landscape.

Telecoms Looking for Chips

Semiconductor chips may be tiny, but they play a huge role in the global economy. Doubly so in times defined by a need to work from home and increased digitisation. Gartner analysis shows that global semiconductor sales revenues rose by 10.4% in 2020, led by “Memory, GPUs and 5G chipsets.”

Demand is up across many industries, illustrated by the Financial Times’ report on the global chip shortage affecting even toasters and washing machines and costing car manufacturers more than $60 billion.

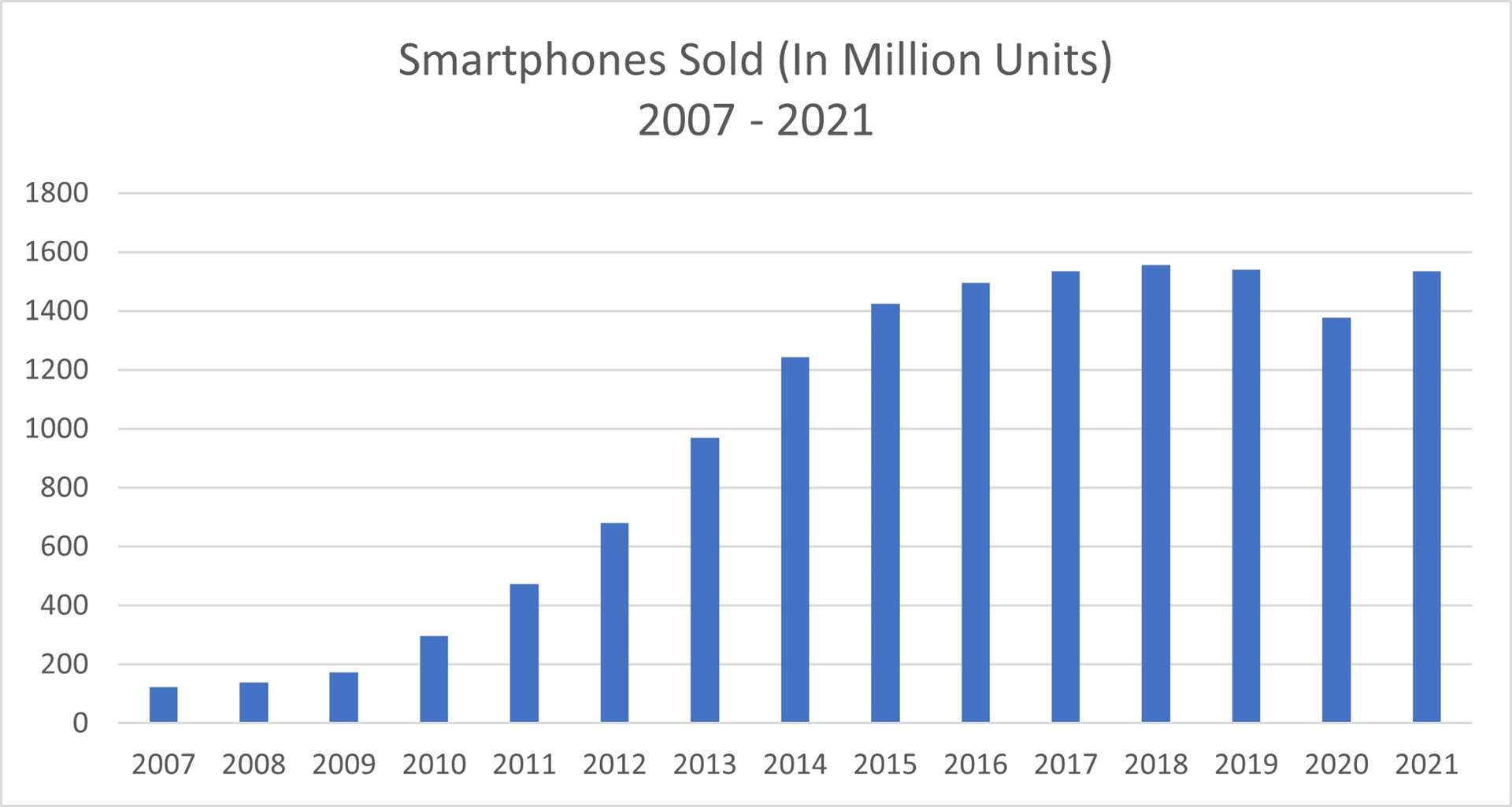

Data: Statista, Graph: BDO Global. The figure for 2021 is a projection.

Telecoms often have broader product portfolios than the likes of car manufacturers, making it challenging to calculate the exact impact of a dearth of semiconductors. However, the shortage has led to price increases for core components such as 4G and 5G chipsets, with phone producers warning that it can lead to increased prices. According to Goldman Sachs economists, prices of affected goods could rise as much as 3%. Considering the number of individual units in a product like a smartphone or a modem, companies could be looking at vastly increased expenses - if they have access to the necessary parts at all.

Further compounding the issues is the ongoing trade conflict between China and the U.S. Chinese Huawei and others hoarded both chips and chip-making equipment ahead of a U.S. trade embargo, contributing to supply chain issues.

Slow Changes Underway

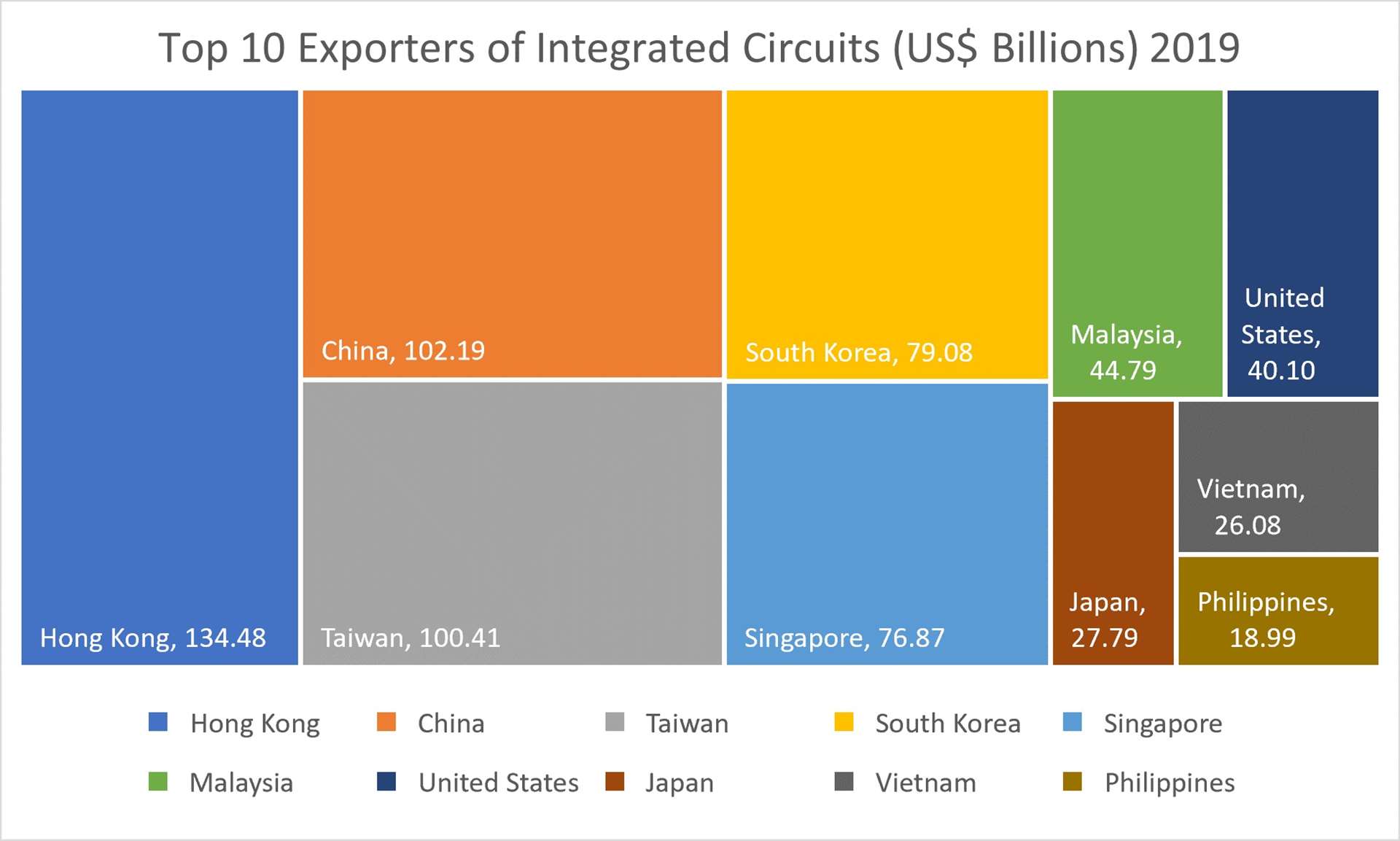

The lack of available chip-making machines and materials both contribute toward the shortage of chips likely affecting companies for all of 2021 and well into 2022. While U.S. President Biden and European counterparts seek to boost domestic production of silicon for applications ranging from power steering to 5G, it will take time for any effect to come of it. For example, the U.S. is home to around 12% of the global semiconductor manufacturing, down from 37% in 1990. Building new chip production facilities is likely to take years.

Data: International Trade Centre,

Furthermore, ASML Holding, a 35-year-old Dutch semiconductor equipment vendor, is practically the sole provider of the extreme ultraviolet lithography (EUV) machines needed to produce advanced, modern chips. Samsung has committed to spending $116 billion over the coming ten years on building out its EUV manufacturing capabilities. Not far behind is Taiwan’s TSMC, which has committed $100 billion to similar efforts. In other words, initiatives to onshore chip production may struggle due to lack of – or intense competition for – the necessary equipment.

Exploring Alternatives and New Initiatives

All of the above means that telecoms could be in for disruption in the coming years. Diversification strategies have resulted in many telecoms having non-traditional products and services in their portfolios – especially related to the technology sector. This has led to increased risk exposure to chips shortages that stretch beyond current core services and can change telecoms’ earnings projections and project runtimes.

For example, IHS Markit research shows that 11% of all semiconductor parts had more than ten weeks added to lead times, 18% increased from five to ten weeks, and 75% had an increase overall, most coming in the past three months. One example is 5G networks. Here, the shortages have already led to delays for projects, 5G roll-outs, and signing up new customers.

Throughout the telecoms industry, companies are already undertaking upgrades and similar initiatives to improve resilience throughout supply and value chains to help realise the potential of their businesses. At BDO, we have developed the 7P-model to assist companies in achieving just that.

For telecoms facing the impact of a chip shortage, alternative approaches need to be explored.

One is the opportunities found in new partnership models. One such example is the collaboration between Dish and Amazon on 5G traffic. Traffic collected by Dish's equipment will be computed in an AWS public cloud. This represents a significant departure from the traditional wireless network design, which have tended to rely on closed cloud systems belonging to the network operators. Dish will, in essence, put its 5G network software into AWS' public cloud, enabling it to scale computing needs more fluently – and negate the need for hardware purchases.

Another development is companies looking to collaborate on creating sturdy backup options for their supply chains.

Addressing Financial and Reporting Uncertainties

For telecoms, adjusting to the chip shortage can also involve revisiting financial projections and existing strategies. For example, companies will need to consider whether current business models are optimal – or even possible. In the latter category are areas such as just-in-time production strategies and operating with minimal storage facilities.

.jpg.aspx?lang=en-GB)

Data: Ericsson, Graph: BDO Global

The projected growth of 5G subscriptions and networks may also need to be revisited. Furthermore, the projected increase in data usage – and correlated subscription fees – may have to be recalculated.

Such risks, and some of the mitigating strategies, are detailed in the most recent edition of the BDO Telecoms Risk Factor Survey.

Each step will involve addressing several sub-parts. Several examples include:

- Revisiting financial projections: Includes adjusting future revenue forecasts – especially for products and services impacted by the shortage.

- Establishing further vendors and distribution diversification: Calculating costs associated with establishing secondary supply chain sources.

- Financial reporting: The need to stockpile inventory may affect cycle counting and period-end physical counts.

- Revenue and Capex projections: The combination of COVID-19 and a chip shortage may delay 5G delivery, which could affect revenue and Capex projections.

Some of the steps that telecoms may consider to mitigate these impacts include:

- Evaluating and reacting to the possible implications on financial reporting and audit requirements.

- Revisiting key economic assumptions to recheck and update their validity.

- Communicating potential impacts to shareholders, lenders, and investors.

- Crafting contingency plans to address any changes and possible compliance issues.