SWITZERLAND - Referendum on Swiss Tax Reform

February 2019

Following the expiry of the referendum period and the signing by more than the required 50,000 individuals of the petition requesting a referendum on 17 January 2019, the Swiss public will vote on the Federal Act on Tax Reform and AHV Financing ("TRAF"; formerly referred to as "Tax Proposal 17"). The referendum will take place on 19 May 2019 (see Graph 1 below).

Graph 1: Expected timing

The reform's main objective is to secure Switzerland's position as an attractive business location for multinational groups and to restore international acceptance of the Swiss tax system.

Overview of main measures of the TRAF

The current preferential tax regimes which are no longer internationally accepted will be abolished, and the TRAF includes a set of new measures aimed at providing a future fiscal system that will still be competitive. Mandatory measures will have to be implemented by all cantons. Optional measures may be included in cantonal tax legislation at the discretion of the respective cantons, or based on specific entitlement.

An overview of the most important measures for multinational groups is listed below:

- Termination of existing tax regimes (mandatory);

- Patent Box regime at the cantonal level (mandatory);

- R&D super deduction (optional);

- Disclosure of hidden reserves (mandatory);

- Notional interest deduction on equity (applicable to the canton of Zurich only); and

- Restrictions of overall tax relief (mandatory, maximum relief limited to 70%).

For a more detailed discussion of the above tax measures, see World Wide Tax News, Issue 48 (July 2018).

Cantonal tax rate reductions

Although the reduction of the cantonal corporate income tax rates is not formally covered by the TRAF, this additional measure is part of the reform strategy. I.e., most cantons not already applying a rate of between 12% - 14% plan to reduce their corporate income tax rates in order to remain attractive to companies that currently benefit from a preferential tax regime.

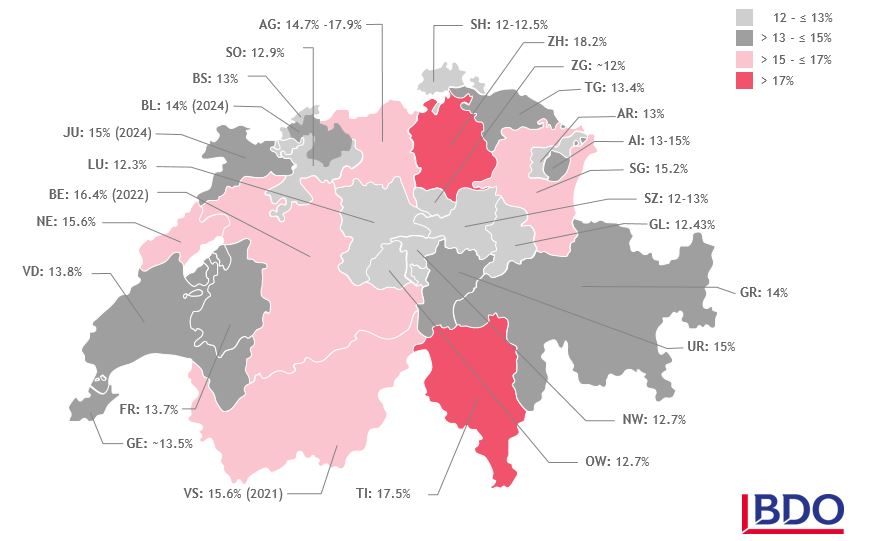

While some cantons had not communicated any concrete plans for their future tax rates in the summer of 2018, and even though a few cantons are still rather reserved with publishing their plans, the picture is much clearer today. Graph 2 provides an overview of the envisaged corporate income tax rates in the respective cantons (combined corporate income tax rate including federal, cantonal and communal tax to be applied on a company's earnings before tax/EBT).

Graph 2: Envisaged effective corporate tax rates at cantonal level Next steps

Next steps

Irrespective of the outcome of the referendum on 19 May 2019, the set deadlines and processes of the TRAF's implementation may still be met and the contemplated date of enactment of the TRAF remains 1 January 2020 (as depicted in Graph 1 above).

As the cantonal tax rate reductions are not covered by the formal reform package, the cantons may adjust these at an earlier (or later) stage. For example:

- The canton of Vaud has provided early clarity and already applies the reduced rate of 13.8% as of 2019

- Basel-City, following a clear 'yes' to the proposed rate reduction in its cantonal referendum on 10 February 2019, may enact the reduced rate of 13% already as from 2019..

- Berne had experienced difficulties in reducing its rate due to its public's rejection and thus has to restart the process

- Zug and Zurich will still have to discuss their plans within cantonal parliament this coming spring

- A few other cantons, even though clear about their plans, have not yet sent their bills to their cantonal parliament. In summary, due to the short timetable, most cantons are pushing ahead with the implementation of the reform into their cantonal tax laws.

Should the Swiss voters reject the TRAF (as they did with the previously contemplated Corporate Tax Reform III on 12 February 2017), Switzerland will have to find another solution to abolish the internationally criticised tax regimes immediately. Otherwise, sanctions from the EU and OECD may possibly no longer be repelled.

In this case, the federal administration might consider implementing a "small solution" that solely focuses on the abolishment of the current preferential tax regimes. Excluded are, as sovereign acts, the contemplated reductions of the cantonal corporate income tax rates, which do not require approval at federal level.

Outlook

Since most major parties support the new law, and the referendum was supported by political minorities only, we are quite confident that the public vote in May 2019 should produce a positive outcome. Swiss tax laws may then smoothly transition into internationally accepted legislation, and Switzerland's position as an attractive business location for multinational groups may well be maintained.

Nevertheless, the situation remains exciting. No matter what the result of the referendum, the tight timing requires a swift analysis by taxpayers on how they plan their transition to the new legislation.

An update on this topic will be provided immediately after the results of the public voting are published.

Kerstin Heidrich

kerstin.heidrich@bdo.ch