The IRAS’ COVID-19 transfer pricing guidance and what it means for companies

The Inland Revenue Authority of Singapore (“IRAS”) has released Transfer Pricing guidance as part of its COVID-19 Support Measures and Tax Guidance, to provide certainty and help businesses which may be affected by the COVID-19 pandemic.

Back in September 2020, guidance was provided on two key aspects:

- COVID-19 transfer pricing analysis and documentation to support transfer pricing outcomes.

- Expectations of existing/ new Advanced Pricing Arrangement (“APA”) applications.

Following the Organisation for Economic Co-operation and Development's (“OECD”) issue of the “Guidance on transfer pricing implications of the COVID-19 pandemic” in December 2020, IRAS extended its guidance in January 2020 to the following areas:

- Treatment of government assistance in relation to transfer pricing.

- Losses and allocation of COVID-19 specific costs.

- Comparability issues in benchmarking studies.

This article summarises the key takeaways of this guidance.

COVID-19 transfer pricing analysis and documentation

IRAS has expanded on its prescriptive documentation content requirements, particularly for taxpayers whose operations have been adversely affected by COVID-19. These taxpayers will need to provide the requisite information to articulate the commercial realities faced, in order to support the arm’s length nature of their related party transactions during FY 2020.

BDO insight: IRAS has affirmed that it is receptive to taxpayers’ explanations about COVID-19 impacted transfer pricing outcomes, to the extent supported by market and independent party evidence. Even though the FY 2020 Singapore transfer pricing documentation reports are only due at the point of tax filing for the year (i.e. by 30 November 2021), taxpayers should plan ahead to build up a body of robust and contemporaneous evidence which can support their transfer pricing policies, whilst the memory is still fresh. The content required by IRAS is extensive, and taxpayers should commence the documentation exercise at the earliest possible.

Required additional COVID-19 transfer pricing analysis

- Analysis of how COVID-19 has affected the taxpayer’s industry, and specifically, the taxpayer;

- Comparison of pre- and post- COVID19 decision-making authority;

- Functional profile of transacting related parties before and after COVID-19;

- Contractual arrangements and details of any changes in obligations or terms and conditions arising from COVID-19;

- Comparison of budgeted and actual achieved profitability or losses, accompanied by reasons to explain variances, and supporting evidence; and

- Details of COVID-19 specific government assistance/regulations which have impacted the taxpayer’s operations.

Transfer pricing adjustments

Importantly, IRAS explicitly affirmed its expectation for taxpayers to actively review FY 2020’s transfer pricing outcomes, and to make adjustments if there are deviations from the arm’s length range. Considering COVID-19’s exceptional nature, IRAS is allowing a one-off concession for taxpayers to use term testing (a.k.a. multi-year testing) if annual testing results in volatility.

BDO insight: The onus is on taxpayers to proactively review and make transfer pricing adjustments, and taxpayers cannot take a “wait and see” approach. Even if FY 2020 financial results have not been finalised, it will be good to do a preliminary assessment on how results using term testing would look, so any transfer pricing adjustments which need to be made are properly communicated and accounted for within the group, including the corresponding accounting adjustments by the related counter-parties. We also note that the IRAS has extended the term testing concession to both FY 2020 and FY 2021, which will help companies with a March or June financial year end, as the adverse effects of the pandemic will be more apparent for FY 2021.

Illustration - Term Testing Concession

Based on transfer pricing analysis, Company A has a functional profile of a limited risk distributor, to be rewarded with an operating margin (“OM”) between 3% and 5% for its distribution activities (referred to as the “Arm’s Length Range”).

- Company A’s actual results for FY 2018 to FY 2020 are summarised in the table below.

- Under annual testing, the FY 2020 OM achieved is (6.67%), significantly below the Arm’s Length Range. The true-up transfer pricing adjustment (to reach an OM of 3%) would be SGD 1,450,000.

- Under term testing, the average OM achieved for FY 2018 to FY 2020 is 2.14%, which is only slightly below the Arm’s Length Range. The true-up transfer pricing adjustment (to reach an OM of 3%) would be SGD 600,000.

Government assistance

IRAS has clarified that where benefits received from government assistance (eg. Job Support Scheme “JSS”) are economically relevant, the taxpayer must consider such benefits as part of the transfer pricing analysis. Whilst government assistance may reduce the negative impact of a risk, it should not change the allocation of risk in a related party transaction. Taxpayers are expected to retain the benefit from government assistance payments, unless there is evidence that independent parties would have passed on or shared the benefits with another party.

BDO insight: Whilst the clear position taken by the IRAS provides welcome clarity on how government assistance payments should (or in this case, should not) be considered when computing related party transfer prices, taxpayers should note that foreign tax authorities (where the related parties are located in the relevant jurisdiction) may hold a different view. To manage this risk, we recommend that taxpayers proactively assess the impact of IRAS’ position on the transfer prices calculated, and consider whether any transfer pricing adjustments need to be made.

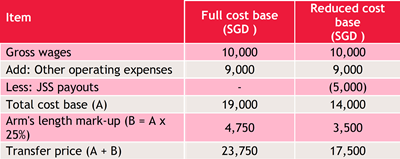

Illustration - Government Assistance

- Company B is a contract manufacturer for its overseas related parties. An independent company charges for similar contract manufacturing services based on its fully loaded manufacturing costs and a mark-up of 25%.

- During FY 2020, Company B received JSS payouts of SGD 5,000 to subsidise its local employees’ wages.

- In computing Company B’s transfer price, unless there is reliable evidence showing that third parties would have behaved differently under comparable circumstances, the cost base should not be reduced by the JSS payouts. Company B retains the benefits from the JSS payouts, and the cost base on which to apply the 25% mark-up is SGD 19,000, resulting in a transfer price of SGD 23,750.

Losses and allocation of COVID-19 specific costs

The extent to which “limited risk” entities are able to share group FY 2020 losses is dependent on the allocation of risks amongst the entities in the group. IRAS illustrates this with an example of Company C, a limited risk distributor within a group. If Company C is not meant to assume any market risk or inventory risk, Company C would not be expected to bear any part of the losses associated with the playing out of these risks. However, if Company C is assessed to assume some market risk but not inventory risk, Company C may share the losses resulting from fluctuations in the market demand, but not any losses resulting from inventory obsolescence.

BDO insight: Risk analysis between related parties to a controlled transaction will be more important than ever, particularly focusing on the pandemic’s impact on business models, and how entities within a group managed transfer pricing risks as a result of COVID 19. Inter-company contractual agreements will also come under scrutiny, so taxpayers will need to ensure that where allocation of risks has changed, the relevant agreements have also been revised to reflect this.

Comparability in benchmarking studies

For FY 2020 and subsequent years, the COVID-19 economic disruption may cause more pronounced comparability differences when establishing benchmarks for routine entities. IRAS has clarified that comparable companies which suffer losses in the year(s) affected by COVID-19 can be acceptable, provided they satisfy other comparability criteria and do not suffer sustained losses (i.e. over the tested period, they make a weighted average profit and are profitable for more than half of the tested period).

BDO insight: IRAS’ confirmation that companies that suffer losses in the COVID-19 period (but not persistent losses in the past years) can be included in benchmarking studies will help enhance comparability when taxpayers prepare transfer pricing documentation for COVID-19 impacted years. We expect further guidance when financial information for FY 2020 and subsequent years become available in the databases.

COVID-19 impact on APA

IRAS notes that COVID-19 may significantly impact the business operations and economic performance of taxpayers, jeopardising the spirit of APAs and attached covenants, which is to provide taxpayers with certainty on transfer pricing arrangements, whether on a unilateral or bilateral/ multilateral basis.

BDO insight: IRAS’ guidance on APAs is largely aligned with OECD, recommending that taxpayers considering APAs, having existing APAs, or currently negotiating APAs with IRAS, assess how COVID-19 might have impacted the critical assumptions of the APAs or the financial results. Taxpayers are encouraged to engage with IRAS to discuss any concerns.

Final takeaway

Taxpayers can expect IRAS to continue to initiate additional appropriate updates to the practice guidance during the periods going forward, and to proactively review financial outcomes which may be impacted by COVID-19. The best course of action is for taxpayers to respond to business disruptions in a timely manner, and plan ahead to build up a body of robust and contemporaneous evidence which can support their transfer pricing policies applied over the course of the COVID-19 pandemic.

Elis Siok Ping Tan

elistan@bdo.com.sg

Yun Qi Koh

yunqi@bdo.com.sg