Subsidiary fixed establishment for VAT purposes?

A fixed establishment is a secondary establishment of a business in a country other than the country of the principal establishment. Regarding the supply of services to businesses, the main VAT rule is that the service is subject to VAT in the country where the customer is established. If a fixed establishment purchases the service, the place of supply is the country where the fixed establishment is located. For the supply of services to a private consumer, the main rule is that a service is subject to VAT where the supplier is established. Again, if the fixed establishment supplies the service, the place of taxation is where the fixed establishment is located. It is therefore essential to determine whether a customer or a performing entrepreneur has such a fixed establishment. If an entrepreneur has permanent access to personnel and resources to perform (or purchase) services, this qualifies as a fixed establishment. In the Dong Yang Electronics case, the European Court of Justice (ECJ) ruled that a subsidiary may also qualify as a fixed establishment. However, this is not automatically the case.

The Dong Yang case

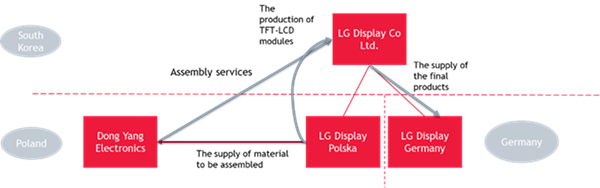

Dong Yang Electronics assembled printed circuit boards on behalf of LG Display Co. Ltd., a company established in South Korea. The materials were provided to Dong Yang by LG Display Polska, a subsidiary of LG Display Co. Ltd. The printed circuit boards were used by LG Display Polska to produce TFT-LCD modules. These modules became the property of LG Display Co. Ltd., which supplied them to LG Display Germany Gmbh. Schematically this can be shown as follows:

Dong Yang Electronics sent the invoice for the assembly services to LG Display Co. Ltd. and did not charge Polish VAT. Dong Yang Electronics assumed that the assembly service was taxed in South Korea, where LG Display Co. Ltd. is established. However, the Polish tax authority considered that LG Display Polska was a fixed establishment in Poland of LG Display Co. Ltd and that Dong Yang Electronics had supplied its assembly services to that Polish fixed establishment of LG Display Co. Ltd. According to the Polish tax authority, Dong Yang Electronics should have charged Polish VAT on the supply of the assembly services to LG Display Co. Ltd.

According to the Court of Justice, the mere fact that the subsidiary (LG Display Polska) is an independent legal entity cannot mean that it can never qualify as a fixed establishment in Poland of LG Display Co. Ltd. It is necessary to assess whether the requirements for a fixed establishment are met in the light of economic and commercial reality. Dong Yang Electronics was not required to examine the contractual relationships between LG Display Co. Ltd. and LG Display Polska to determine whether LG Display Co. Ltd. has a fixed establishment in Poland. That would go beyond the usual due diligence required of an entrepreneur.

Consequences of the judgement for entrepreneurs

The judgement of the Court of Justice shows that the assessment of whether there is a fixed establishment for VAT purposes is a factual matter. The existence of a subsidiary, an independent legal entity, does not automatically rule out the presence of a fixed establishment for VAT purposes. Nevertheless, in our opinion, a subsidiary cannot easily qualify as a fixed establishment. There will have to be close contractual provisions, enabling the parent company to dispose of the subsidiary's staff and resources like the situation in which the subsidiary employs the staff or owns the resources. Additionally, we deduce from the Court of Justice's judgment that the duty of investigation on the part of the supplier, to determine whether a fixed establishment of the customer is present in a given country, does not go beyond the obligations of a diligent businessman. In particular, the supplier is not required to carry out checks that would, as it were, take over the task of the tax authority.

Do you or does your client have a fixed establishment?

It is a factual matter to determine whether you or your customer has a fixed establishment. However, the VAT consequences can be considerable if you have not determined this correctly. If VAT has not been calculated correctly, the local tax authority may impose an assessment on you. It is therefore essential to determine whether you or your customer have a fixed establishment. The Court of Justice seems to have introduced a certain safety net whereby, if the entrepreneur has acted carefully in determining whether its customer has a fixed establishment, they are not liable for paying any additional VAT.

Emilia Wolnowska

emilia.wolnowska@bdo.pl

Marek Sporny

marek.sporny@bdo.pl

Madeleine Merkx

madeleine.merkx@bdo.nl