Beginning 1 January 2021 - New rules for selling goods directly to UK customers

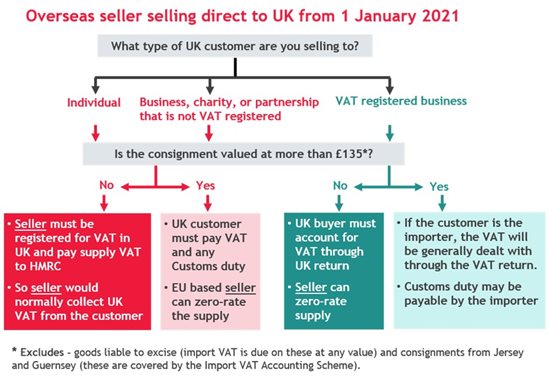

Overseas businesses selling goods directly to UK consumers and UK businesses that are not VAT registered must apply new VAT and Customs Duty rules from 1 January 2021.

As well, there are additional new rules for:

- Sales of low value goods (consignments valued at under £135*) that have been imported into the UK to sell on to consumers, businesses, and via marketplaces – sellers must be VAT registered.

- Sales of low value goods located outside the UK and sold through marketplaces and platforms – platforms and marketplaces will declare the VAT.

* Excludes goods liable to excise tax (import VAT is due on these at any value), and consignments from Jersey and Guernsey (these are covered by the Import VAT Accounting Scheme).

The following flow-chart shows the issues to be considered when overseas sellers sell directly to the UK:

What action should sellers based outside the UK take?

- Identify the VAT status of your buyer for low value goods – this may require additional processes at ordering, and potentially linking to the UK register of VAT registered persons to verify. You may also wish to review the ‘customer experience’ so that any VAT or duty cost to your customers is clear. This will also apply to goods over £135.

- The seller will still be required to send the goods to the UK with a customs declaration as normal and may do this itself or by using a courier or other agent. This applies to goods of any value sent to the UK.

- If sales of any low value goods are made to UK consumers, you will need to register for VAT in the UK (if you aren’t already – Her Majesty’s Revenue and Customs (HMRC) will charge penalties if this is not done).

- As a VAT registered business in the UK, the seller will need to comply with UK VAT rules including filing returns, paying tax, and keeping digital records. However, as a VAT registered business, the seller will be able to reclaim VAT that is incurred in the UK, subject to holding proper invoices. Every three months the seller must file a VAT return and pay to HMRC the VAT on sales made (both to consumers and non-VAT registered businesses), less the VAT on purchases bought in. Sellers based outside the UK can manage the process remotely or they can appoint a local agent, for example BDO UK LLP.

Wayne Neale

wayne.neale@bdo.co.uk