The Danish implementation of EU’s Quick Fixes

The VAT rules for international trade have been changed from 1 January 2020. As a result, EU Member States have been implementing the new harmonised rules (the so-called quick fixes) in their national legislation. We will here try to give an overview of how Denmark has implemented these changes

Substantive requirements for intra-Community supply

To prevent VAT fraud, the EU has introduced some requirements for intra-community supply. These rules influence the rest of the quick fixes, since they must be followed to apply for the exemptions.

Seller responsible for transport

If the seller is responsible for the transport of goods then the seller can opt for two different ways (A or B) to fulfil the requirements for transport documentation:

- The seller must have at least two separate documents:

- Signed consignment note

- Bill of lading

- Invoice from the transporter

Or

- The seller must have at least one of the above-mentioned documents or one of the below mentioned documents:

- Insurance documents regarding transportation

- Proof of payment for transportation could be from the bank

- Official documents from authorities for arrival of the goods in the recipient country

- Signed documents for the receipt of the goods in the recipient country

Documents used must be from two independent parties.

Buyer responsible for transport

If the buyer is responsible for transportation then the seller must have one of the documents from either point A or B plus a signed statement from the buyer stating that the buyer is responsible for the transportation and information of where the goods are to be transported.

Simplification of the consignment rules

An uneven practice among the Member States has led the EU to introduce harmonised rules on when companies are to be registered for VAT if they have consignment stock.

It is now also possible for companies to have consignment stocks in Denmark and avoid VAT registration.

Under the new rules, a transfer of goods from a company in an EU country to a buyer in another EU country will no longer result in a VAT registration obligation if the parties conclude a consignment agreement. Instead, the sale should be treated as an intra-Community supply when the purchaser takes the goods out of the stock.

There are specific conditions under which a consignment agreement can be considered concluded. Overall, there will be a consignment agreement when a seller and a buyer enter into an agreement that the seller's goods are put into stock at the buyer, who, at some point in the future (within 12 months) then acquires ownership of those goods. However, the transfer is not considered a sale until the buyer acquires ownership of the goods, and there are further conditions for when this transfer will be exempt from VAT.

First, the seller must not be registered in the country the goods are transferred to. As well, the seller must know the identity and the VAT number of the buyer and both the seller and buyer must keep a register related to the goods. These rules do not apply, however, where the seller transfers goods to several buyers.

Chain transaction rules

Denmark has implemented the new EU rules regarding chain transactions in order to comply with the EU rules.

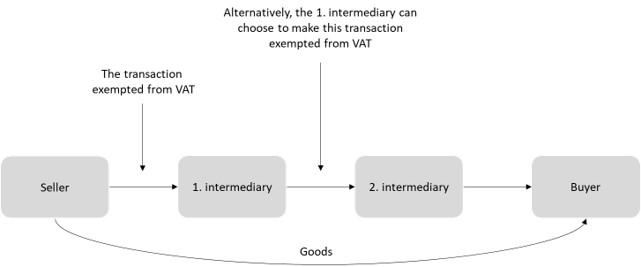

The new rules determine that the main rule is that the transaction in the first incident, which is the sale from the seller to the first intermediary, will be considered as the intra-Community supply in case the intermediary organises the transport. However, the intermediary must provide a valid VAT registration number to the seller of an EU Member State different from the EU Member State of departure.

Alternatively, the first intermediary has the option of choosing that the transaction from the first intermediary to the second intermediary be exempt from VAT. However, to qualify for this option, the first intermediary must be registered for VAT in the country from which the goods are dispatched or transported, in other words, the country in which the seller is established. And, in this situation the first transaction must be with local VAT.

Sten Kristensen

shk@bdo.dk