Increasing challenges relating to “allowable purpose” for intragroup loans

The ability to take a tax deduction for interest paid on loans is a central concern in international group financing. For UK-based businesses, a number of restrictions are imposed through UK tax legislation, from thin capitalisation rules to the corporate interest restriction that limits interest deductibility, but perhaps the most fundamental hurdle is the “unallowable purpose test.”

A UK tax deduction for interest paid by a company will be disallowed if the purpose for paying the interest fails the unallowable purpose test set out in section 442(5) of the Corporation Tax Act 2009. The test is designed to limit the deductibility of interest expense to apply only to genuine business loans—a deduction will be disallowed if the purpose of the borrowing was not to fund normal business or other commercial activities. In simple terms, if the main purpose or one of the main purposes of being party to a debt and paying interest is tax avoidance, this is an unallowable purpose and the corresponding interest paid is disallowed as a deduction for corporation tax purposes to the extent it relates to that unallowable purpose.

While this legislation is well established, three recent court decisions highlight that the UK tax authorities (HMRC) are increasingly challenging companies to prove that their loans are for allowable purposes—changing some established views of how the unallowable purpose rule applies.

Acquisition structures

The recent decision of the Upper Tribunal (UT) in the HMRC v BlackRock case concerned the deductibility of interest expense on a GBP 4 billion intragroup loan. The UT upheld HMRC’s appeal, agreeing that no tax relief was due, as interest paid by a UK funding company was disallowed in full under both the unallowable purpose rule and the UK transfer pricing rules (for a discussion of the transfer pricing aspects of the case, see the article in the September 2022 issue of Transfer Pricing News).

As it has been common to include a funding company in group structures created to facilitate acquisitions, the UT decision may have far-reaching ramifications for many existing structures and change the landscape for future deals.

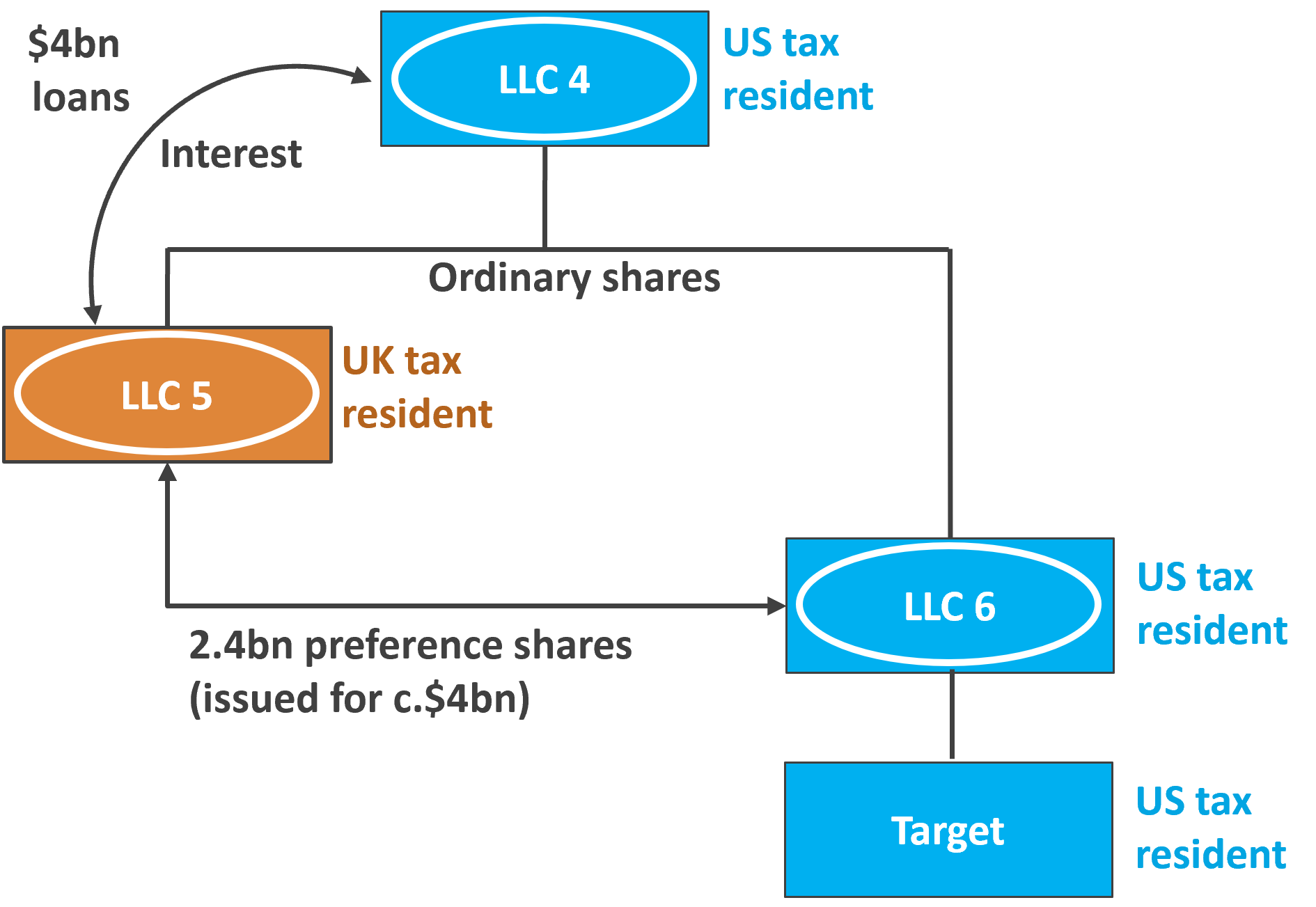

The BlackRock acquisition structure was as follows:

To fund the acquisition, LLC 5 issued loan notes to its immediate parent entity in the group (LLC 4) and then lent the funds to a subsidiary to acquire the shares of the target company. LLC5 was a U.S. entity, but because it was managed and controlled from the UK, it was UK resident for UK tax purposes. LLC 5 claimed a deduction for the interest paid to LLC 4.

Unallowable purpose

Whilst the UT held that there was a main commercial purpose for making the acquisition itself, it found that there was no apparent reason for the chosen UK entity to be the acquiring entity beyond that of obtaining a tax advantage. Although witnesses (i.e., directors of LLC5) had considered the company’s position and agreed that the loan arrangement could be entered into even if UK tax relief was not available, the UT stated it was appropriate to broadly consider the entire purpose of the company (LLC5) when applying the unallowable purpose test. As LLC5 carried out no other transactions, had no other interests or activity and it was contrary to the group’s usual approach (which sought to ensure that all U.S. entities were specifically not UK tax resident), it is unsurprising that the UT concluded that tax avoidance was a main purpose of the inclusion of LLC5 in the acquisition structure.

Wider than just the UK company

In the past, perhaps because section 442 refers to the purpose of “a company,” the wider context of a transaction has not generally been seen as relevant provided the directors of the acquiring company gave proper consideration to entering into the acquisition. However, in the last few years, the courts have tended to adopt wider interpretations of many anti-avoidance rules where there is a clear avoidance purpose to any element of an arrangement.

In an earlier case, JTI Acquisition Company (2011) Ltd v HMRC, a U.S. company also included a UK company in the acquisition structure of a U.S. business and the UK company also claimed interest deductions on the loan notes involved to create loan relationship debits and aimed to surrender them to other UK members of the U.S. group via group relief. The First-tier Tax Tribunal ruled that the decisions of the directors of JTI were not the only decisions that were relevant and that the purposes of the group as a whole had to be considered. When doing this, it held that there was no commercial rationale for the borrowing structure and the group as a whole had clearly aimed to achieve a tax advantage, triggering the unallowable purpose rule for the interest deduction.

Beyond acquisitions

Also in 2022, the case of Kwik-Fit Group and others v HMRC addressed the unallowable purpose issue in relation to rearranged intragroup loans. In essence, a group company had significant brought forward interest deductions (GBP 48 million) which, at that time, it was not allowed to surrender as losses to other group entities. It was, however, a lender to various group companies at low/zero interest rates. Interest received on the loans was relieved by the brought forward interest deductions but at a very slow rate; it would have taken many years to obtain full relief. The group undertook a significant debt restructuring exercise and the loans were refinanced at commercial rates (e.g., 5% above LIBOR), with the net result that the company’s interest receipts increased significantly and its “trapped” interest deductions were used up at a much faster rate. HMRC argued that while the original loans had a commercial purpose, the refinancing exercise was designed to generate a tax advantage and this meant that the unallowable purpose rule applied to the interest paid.

Interestingly, in this case, the wider context of the group was not held to be crucial. The taxpayer argued that as some of the interest-paying companies were loss-making, the arrangement did not create tax savings for the group as a whole. The Tribunal, however, determined that the intention to obtain relief for the trapped interest deductions was sufficient to meet the test of seeking a tax advantage, and that the unallowable purpose rule was triggered.

Comments

In preparing for these cases, HMRC obtained thousands of documents from the taxpayers, including emails, board meeting notes and advice provided to the taxpayers by their professional advisers. This serves as a warning to taxpayers to have sufficient contemporaneous evidence to demonstrate the commercial purpose of a UK tax resident company in issuing and/or being party to a debt instrument, as well as the wider group purpose for the relevant arrangement. Unsurprisingly, the existence of advisers’ papers promising significant tax benefits from specific group arrangements is distinctly unhelpful when the courts are considering a taxpayer’s purposes in entering into the arrangements!

Although the Tribunal’s present approach to the UK’s unallowable purpose test does not create a blanket ban on tax-efficient group structures involving intragroup borrowing, it does mean that any structures comprising loans will be tested rigorously by HMRC to establish their commercial rationale.