ARMENIA - Tax incentives for information technology startups extended

September 2019

The system of granting tax incentives to Information Technology (IT) startups first came into force in 2015 on the basis of the law "On State Assistance to the Information Technology Sector". It is designed to provide IT startups with tax breaks for the first years of their activity. Low rates set under the law are intended to ensure a motivated behaviour for investment and reduce the risk of tax evasion.

In April 2019, the Armenian parliament adopted a set of amendments and additions to the law "On State Assistance to the Information Technology Sector", which extend the term of the above-mentioned tax breaks. As a result, the deadline for applying and obtaining a certificate for tax breaks has been extended to 31 December 2022.

Startups registered between 1 December 2017 and 18 May 2019 could apply for a certificate within 3 months of the time the law entered into force.

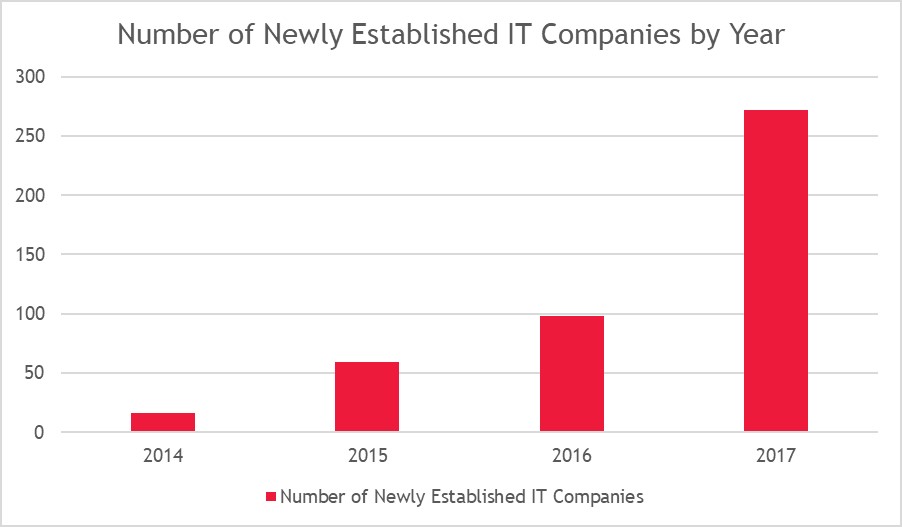

The following brief statistics explain why the obvious positive impact from the earlier amendments to the law influenced the Government in making this decision.

Before the adoption of the law, in 2014, 16 IT companies were established. Since the adoption of the law, that figure has demonstrated a steady growth trend. In 2015, 59 IT companies were established and received a certificate of tax benefits; in 2016, this rose to 98, and in 2017, to 272. The newly established companies have created about 2,400 new jobs, with an average annual salary of AMD 3.0-3.4 million (EUR 5,500-6,300).

Some details of the Law

The tax breaks granted to IT startups exempt them from paying corporate tax of 20% (a zero rate applies under this Law), as well as providing a reduced income tax flat rate of 10% (instead of generally 23%, 28%, or 36%) for employees.

IT startups operating in the following fields can benefit from state support:

a. Software development,

b. Consulting activities in the field of computer technology,

c. Computer system management activities,

d. Data processing, network distribution and related activities,

e. Activities related to web-portal development,

f. Implementation of educational or research programs in the field of information technologies,

g. Electronic systems design, testing and production, computer animation and modelling, as well as design and testing of integrated circuits.

The tax break certificates are granted on a case-by-case basis by the special Commission established by the Government.

Companies applying for a certificate must meet certain requirements, particularly:

- They must be trade organisations or Private Entrepreneurs registered in the Republic of Armenia. The certificate cannot be applied to subsidiaries, economic associations, branch offices, or representatives of foreign legal entities

- The number of employees should not exceed 30

- They must not sell their fixed assets

- At least 70% of turnover must derive from the types of activities defined by the above-mentioned Law

The Law also stipulates that a list will be published both of startups that received the certificate and those to whom a certificate was denied.

This information is for general use - when considering a specific transaction, it is advisable to take professional advice. The effective Law is available in Armenian at http://www.irtek.am/views/act.aspx?aid=78687.

Aharon Chilingaryan

a.chilingaryan@bdoarmenia.am

Anahit Simonyan

a.simonyan@bdoarmenia.am