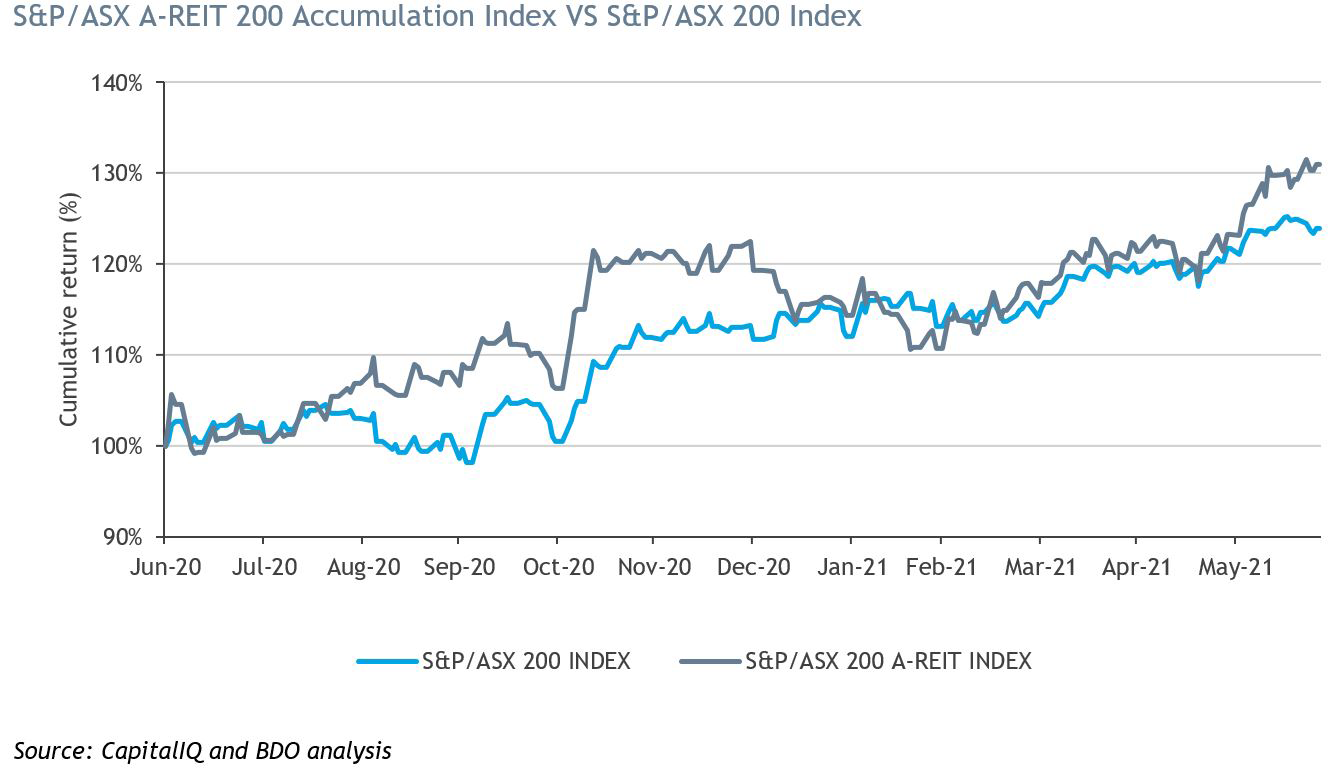

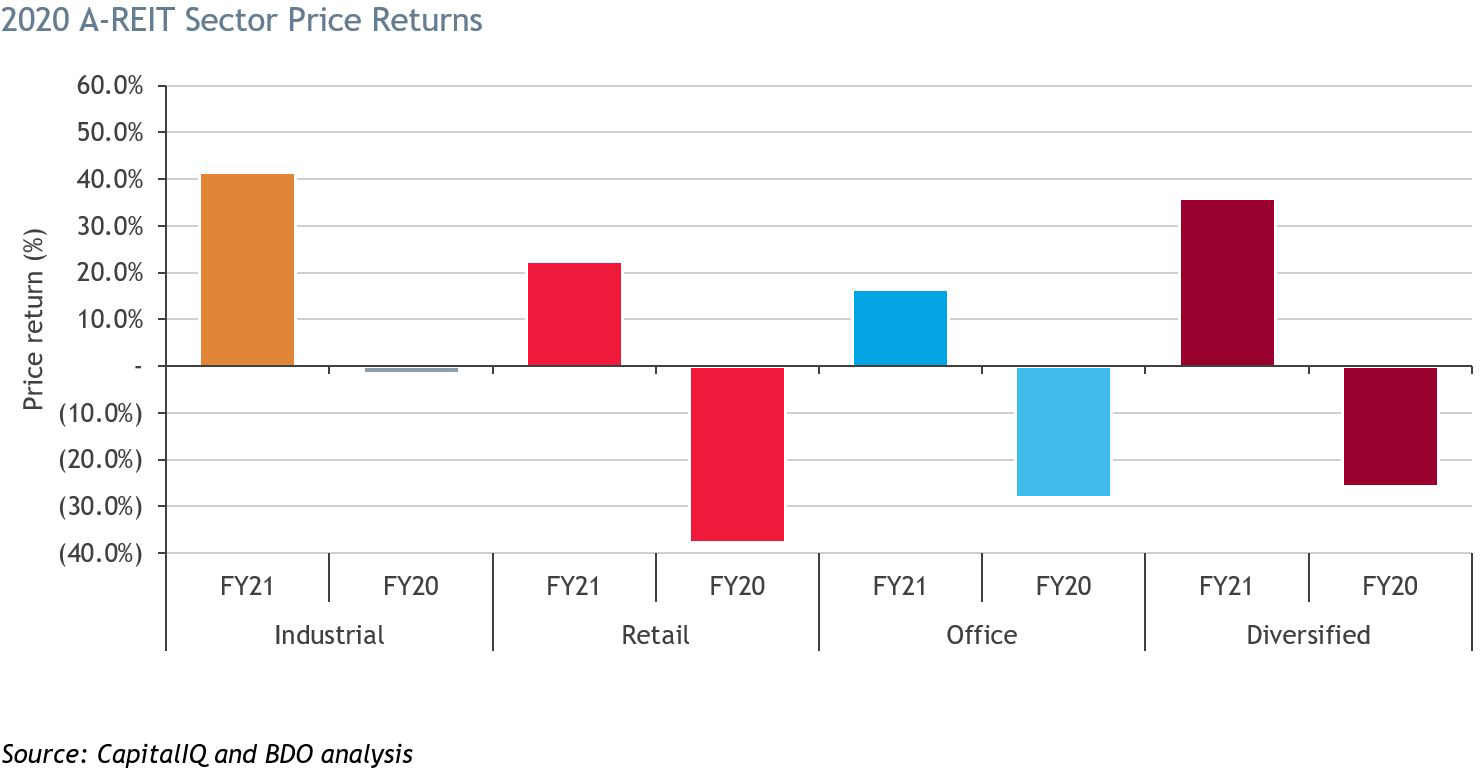

The strong rebound comes after a challenging 2020 for A-REITs when the onset of the COVID-19 pandemic and the ensuing economic downturn had an adverse impact on all the A-REIT sub-sectors.

This survey explores the dynamic listed Australian property industry by ranking the S&P/ASX 200 A-REIT Index trusts based on key financial and investment indicators over the 2021 financial year.

It uncovers three key themes:

- Vaccine uptake and bolstered confidence

- E-Commerce continues to reign

- Playing the long game – interest rates and inflationary pressures.

Download: BDO A-REIT Survey 2021

We are delighted to present BDO’s 27th Annual Survey on Australian Real Estate Investment Trusts. With additional insights from the top performing A-REITs of FY21, the report explores our analysis behind the A-REITs’ resilience and is aptly titled “A Strong Rebound”.

Category Performance Overview

All categories outperformed their FY20 result during FY21 with the industrial category performing the best with 41.4 per cent (FY20: -1.5 per cent), and office was the poorest performing with 16.4 per cent (FY20: -28.2 per cent).

Rebounding Post-Pandemic

A top performer in this year’s analysis, Arena REIT, accredited their strong performance to investment in assets which are necessary for Australians throughout lockdown:

“Our portfolio exclusively invests in social infrastructure property which accommodates tenant partners that deliver essential services to Australian communities. These essential services continued to trade and pay rent through the pandemic, which provided Arena a relative comparative advantage compared to traditional office and retail landlords.”

Aspen Group discussed their flexible business model and its ability to bolster their bottom line through various economic shocks:

“Our approach of having residential, retirement and parks communities positions us well for shocks if they occur. We need to be nimble to react to changes in market conditions. Residential and retirement assets have been very resilient. A strong residential market has led to i