The functions carried out by the CFOs of tomorrow may be quite different as, increasingly, the role is morphing into that of the Chief Value Officer, or CVO. The research findings, detailed in the report entitled Chief Value Officer — The Important Evolution of the CFO have clear implications for the CFO’s role.

The need for a CFO’s level-headed analysis and reporting skills remains key in an increasingly uncertain world. In recent years, corporate boards have had to deal with threats as diverse as a global pandemic, a supply chain collapse and geopolitical uncertainty in Europe and Asia, making data-driven insights vital for company success.

Our research shows that CFOs are increasingly being tasked with responsibilities that go beyond financial reporting and shows how companies are now looking to CFOs for strategy and reporting across a range of non-financial business drivers, including environmental, social, and corporate governance (ESG) performance.

“Value in the past was very straightforward,” said one UK-based CFO interviewed for the research. “It was ‘show me the money’, and it was real money… that you could count with your hands.”

But today, they said, “We also have other values…. What is the value of ESG?”

This trend is thrusting CFOs into the corporate limelight and changing perceptions of the role, says the research.

Historically, “The more enlightened individual, perhaps one who has interacted with the CFO in an organisation, may well see them as the keeper of the purse strings and often … the person who says that the organisation cannot afford to undertake the suggestion made,” says the report.

Now, though, “the role of finance is definitely transforming towards more business support [and] business value add - rather than just finance retrospective reporting,” a Middle East CFO said.

Shifting Landscape

BDO and the ACCA have been monitoring this gradual shift from CFO to CVO, noting the broader range of business needs that finance leaders are having to respond to.

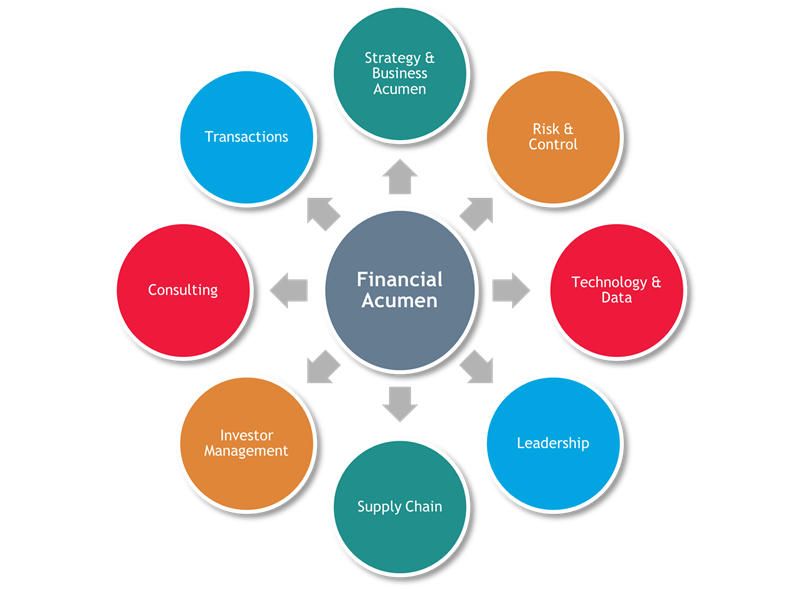

As well as financial acumen, which remains core to the CFO/CVO function, finance heads are increasingly required to have broader skills including leadership, consulting, transactions, supply chain, business strategy, investor management, risk and control, technology, and data.

“The rise of the CVO exemplifies how modern business success is about so much more than financial performance,” says Carly Bleathman, who leads the Finance Function Advisory for Business Services and Outsourcing at BDO in the UK.

“Today’s stakeholders recognise that a whole range of factors, from supply chain resilience to environmental performance, can undermine the value of a business. The CVO is expected to provide insight into the risks and opportunities inherent in all these areas.”

More and more, says the CVO report, “the CFO role is a voice for the organisation, building upon the inherent trust in, and ethical perspective of, the role.”

Agents of Change

A complementary view is that future CFOs will be change agents, drawing on data-driven insights to help organisations achieve their strategic aims.

The report says: “The CFO is the reporter of performance in its broadest sense of both financial and operational performance and, in this role, provides information to others … enabling them to form considered opinions on the relative strengths and opportunities for the organisation.”

Clearly this is a very different brief to that handed to the CFOs of yesteryear—and requires a different set of skills. For those aspiring to become CFOs, “the challenges are greater than in the past,” the report says.

“The gap in the pathway between a more junior role and the CFO role may now be harder to bridge than it was,” it says, although “bridging that gap is worthwhile. The CFO role is one that offers tremendous satisfaction and reward.”

A key implication of the research is that CFOs and CVOs will need to increasingly rely on specialist skills that may only be available on an advisory or outsourced basis.

Assembling all the reporting and analysis skills that a CVO needs might be hard to do in-house, but fortunately there are expert advisers that can deliver the services required. As CFOs move from finance to value, adviser relationships are vital.

Chief Value Officer — The Important Evolution of the CFO

The role of a Chief Value Officer (CVO) is one that is increasingly used in the context of the broader reporting that organisations are now undertaking. Is the CVO role an extension of the CFO role or is it unique? What constitutes value anyway?

To explore these two questions, BDO and ACCA have drawn on the perspectives of nearly 100 finance leaders from across the globe, representing a wide variety of organisations from large global corporates to start-up businesses. The finance leaders included not-for-profit and public sector organisations as well as publicly listed and private equity backed entities.

Copyright © 2023 by the Association of Chartered Certified Accountants (ACCA). All rights reserved. Used with permission of ACCA. Contact insights@accaglobal.com for permission to reproduce, store or transmit, or to make other similar uses of this document.