The trends leading to healthcare technology M&A growth

The trends leading to healthcare technology M&A growth

Investments and M&A involving healthcare technology targets remains high. New opportunities for innovation and growth continuously appear, including within healthcare communication and collaboration.

‘Software is eating the world,’ Mark Andreesen wrote in his 2011 opinion piece in the Wall Street Journal. In healthcare, its appetite seems to be growing.

Healthcare is a broad, multifaceted space. One uniting factor is companies and organisations’ need to digitise, which has become even more pressing because of COVID-19.

The developments create a strong draw for further investment due to healthcare technology’s massive, relatively untapped growth potential. As a result, healthtech, as it is also known, and its subindustries, such as telehealth, digital health, and healthcare communication solutions, are seeing increased growth and competition.

In an evolving market, companies and strategic investors are leveraging inorganic growth through M&A to become the foundation of the future of healthcare.

As the space continues to evolve, driven by the dual forces of innovation and consolidation, we expect to see increased deal activity. A closer look at healthtech communication and collaboration solutions provides a microcosm of broader trends – and what may be on the event horizon.

TMT Tops M&A

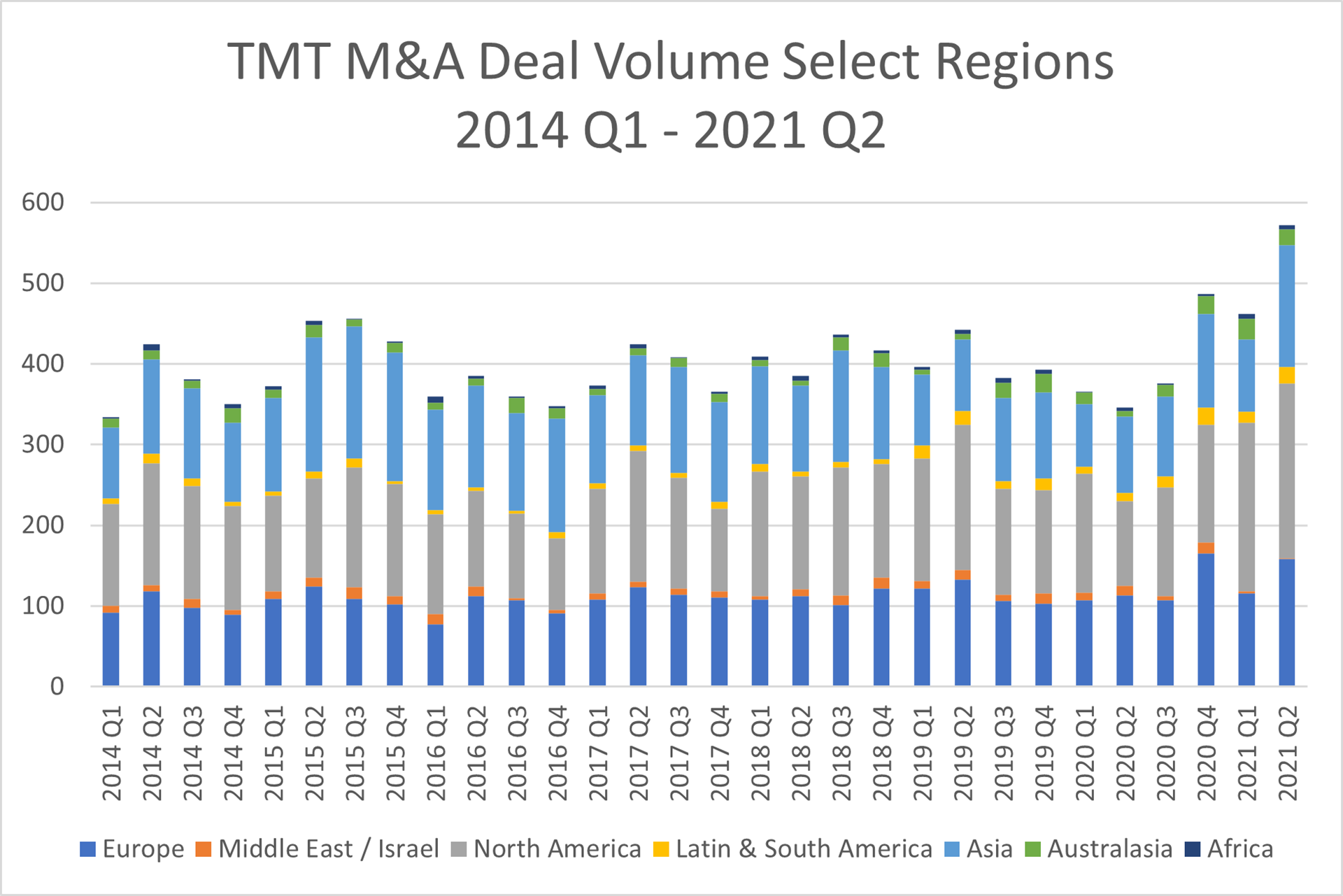

Developments in healthtech mirror the broader technology, media, and telecoms (TMT) sectors. BDO’s M&A data for mid-market deals highlights how TMT’s M&A bull run, led by software, shows no signs of slowing.

For the sixth straight quarter, TMT led mid-market M&A in 2021 Q2. The quarter saw 572 completed deals with a total disclosed deal value of US$63.5 billion. If deal activity continues, 2021 will far surpass 2020, which was itself a strong year.

Data: MergerMarket. Analysis and graph: BDO Global.

While COVID-19 makes it difficult to draw firm conclusions from quarterly year-on-year comparisons, it is worth noting that TMT mid-market deal activity was higher than at any point in the last 30 quarters.

Private Equity (PE) firms remain a prime driver for deal activity across industries, including TMT. During Q2 2021, PEs were involved in 194 buyout deals worth a combined US$30 billion, representing 33.9% of global TMT deal volume and 47% of deal value. In comparison, PEs were involved in 154 buyouts in the first quarter (35.2% of deal volume and 46.6% of deal value in 2021 Q1).

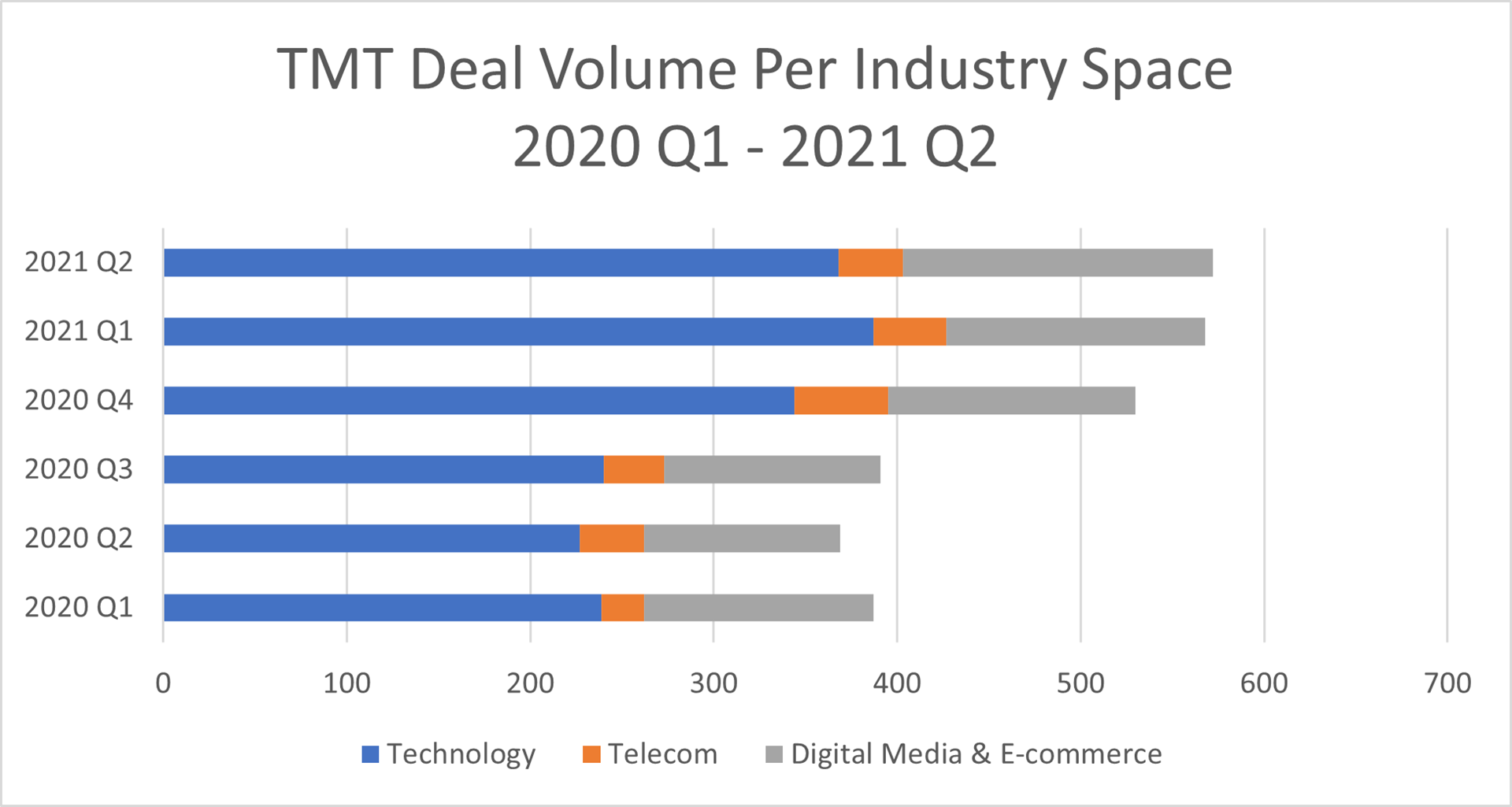

Technology Continues Domination

Within TMT, technology leads activity, followed by digital media & e-commerce. Both sectors saw +60% growth in deal volume between Q2 2020 and Q2 2021. As we have described in previous articles, digital media and ecommerce activity is partially due to the growing investment interest in digital marketing agencies, headless e-commerce software, and e-commerce marketplace aggregators.

Data: MergerMarket. Analysis and graph: BDO Global.

A breakdown of mid-market technology M&A shows that software represents approximately 90% of deal volume. The strong performance of software is in part driven by digitisation across industries. Digital transformation solutions and initiatives alone represent around 12.5% of the US$4 trillion Gartner predicts companies will spend on IT over the course of 2021.

Furthermore, companies are leveraging technology in general, and software in particular, to develop new solutions – or entire business units. Forrester predicts that 30% of Global 2000 companies will have a significant digital product portfolio and 20% will have created digital divisions dedicated to launching disruptive products before the year is up.

Healthtech on the Rise

The dynamics described above also apply to the healthcare space – albeit in some ways with inbuilt delays. Healthcare has traditionally been a conservative space where the integration of new technologies is concerned. Tight regulations, complex industry structures and varying legislation across regions and countries have been contributing factors. This has led to a slower integration of new solutions and technologies.

Already some years before COVID-19, this had begun to change. New technologies and new companies emerged capable of meeting the strict entry bar. However, the market entry costs in money and time, for example, associated with running extensive tests and gaining legislative approvals, remained an issue for many SME companies. Over time, technology has evolved, making it cheaper to innovate and gain market traction. Those trends have accelerated very quickly over the last 18 months, as COVID-19 has created even more impetus for the integration of new solutions and technologies across all areas of healthcare.

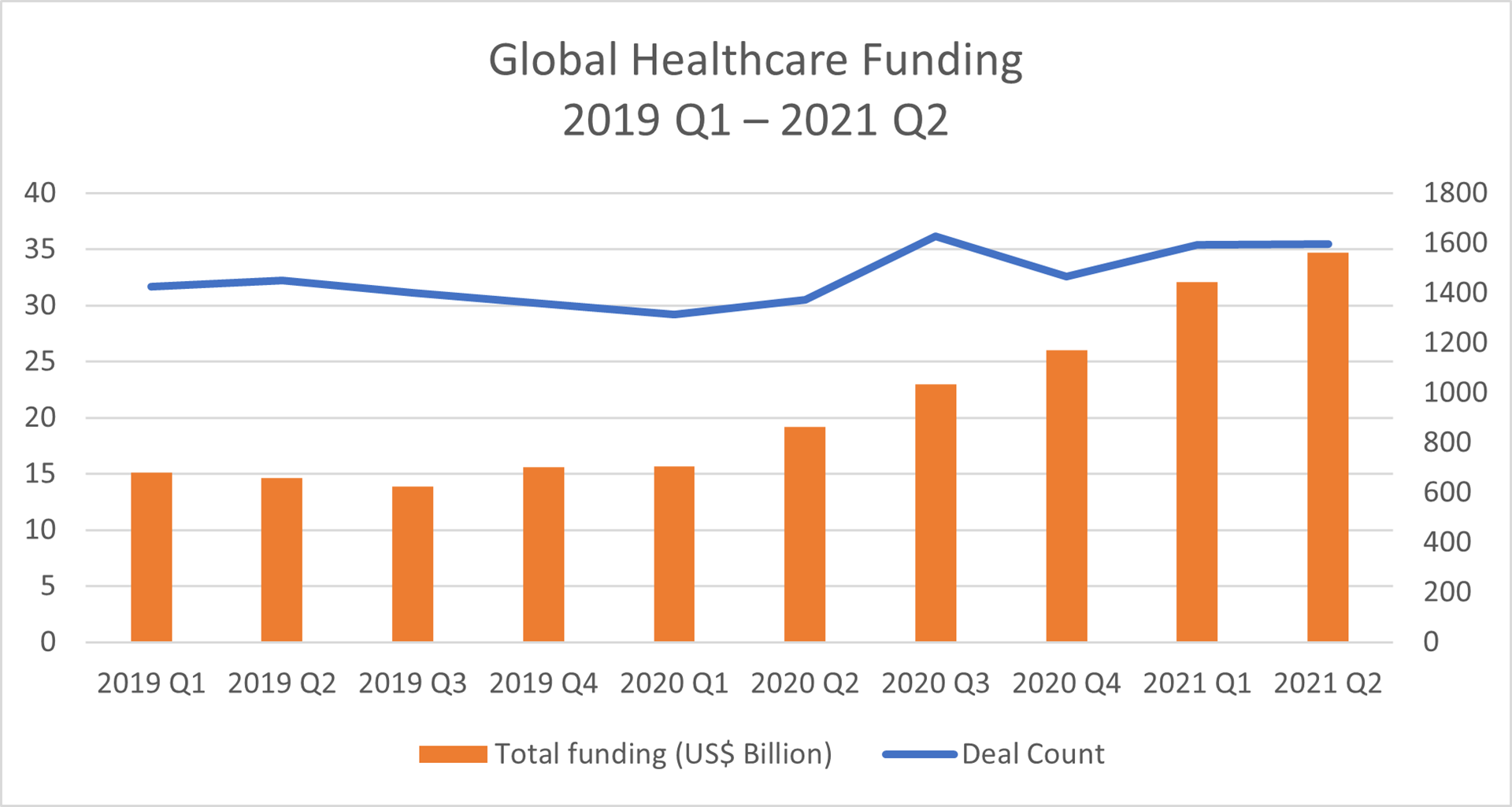

Data: CB Insights, Graph, BDO Global

Within healthcare, including the healthtech space, the growing interest is spurring unprecedented deal and funding activity. CB Insights’ 2021 Health Tech Report charts how global healthcare investment rose for the seventh consecutive quarter, surpassing U$34.7 Billion in funding across nearly 1600 deals during 2021 Q1 alone. Digital transformation initiatives were a prime deal driver, and digital health start-ups accounted for 40% of both the deal number and funding raised.

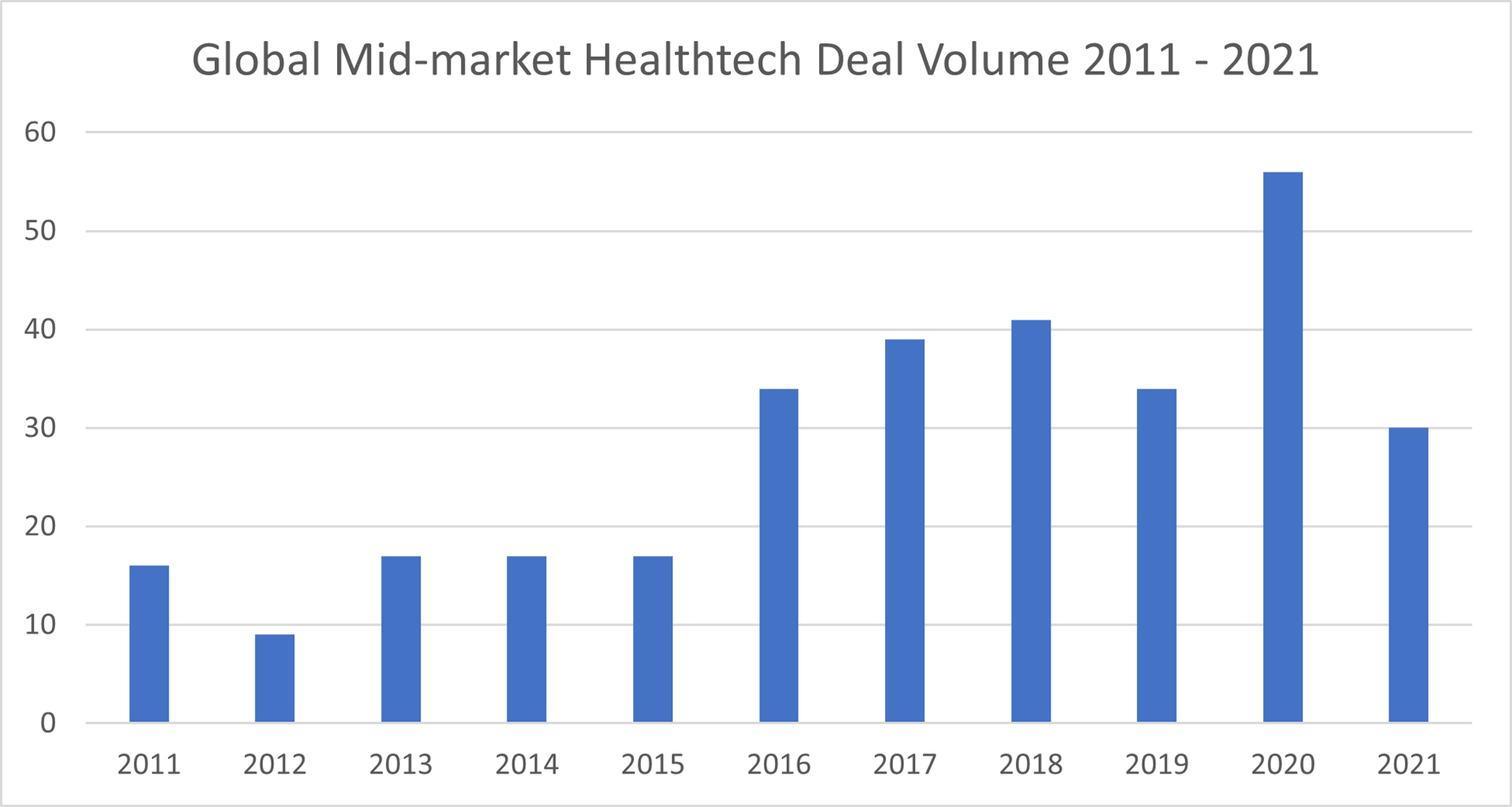

Data: MergerMarket. Analysis and graph: BDO Global. 2021 figures include deals from January through to ultimo June.

M&A activity is also up. BDO’s M&A data shows that 2020 set a high watermark for mid-market healthtech deal activity. A mark that 2021 looks set to surpass.

Market Potential and Digitisation Drive Deals

As mentioned above, new technologies and solutions are proving increasingly adept at meeting the challenges posed by strict compliance demands and unique legislative frameworks. As a result, we see fundamental shifts in how healthcare companies and organisations function, innovate and interact with their clients.

Today, the healthtech market is estimated to be worth up to US$350 billion. Considering that almost 10% of global GDP is spent on healthcare, and the potential for improving customer experiences, streamlining operations and further digitisation, rapid market growth is expected.

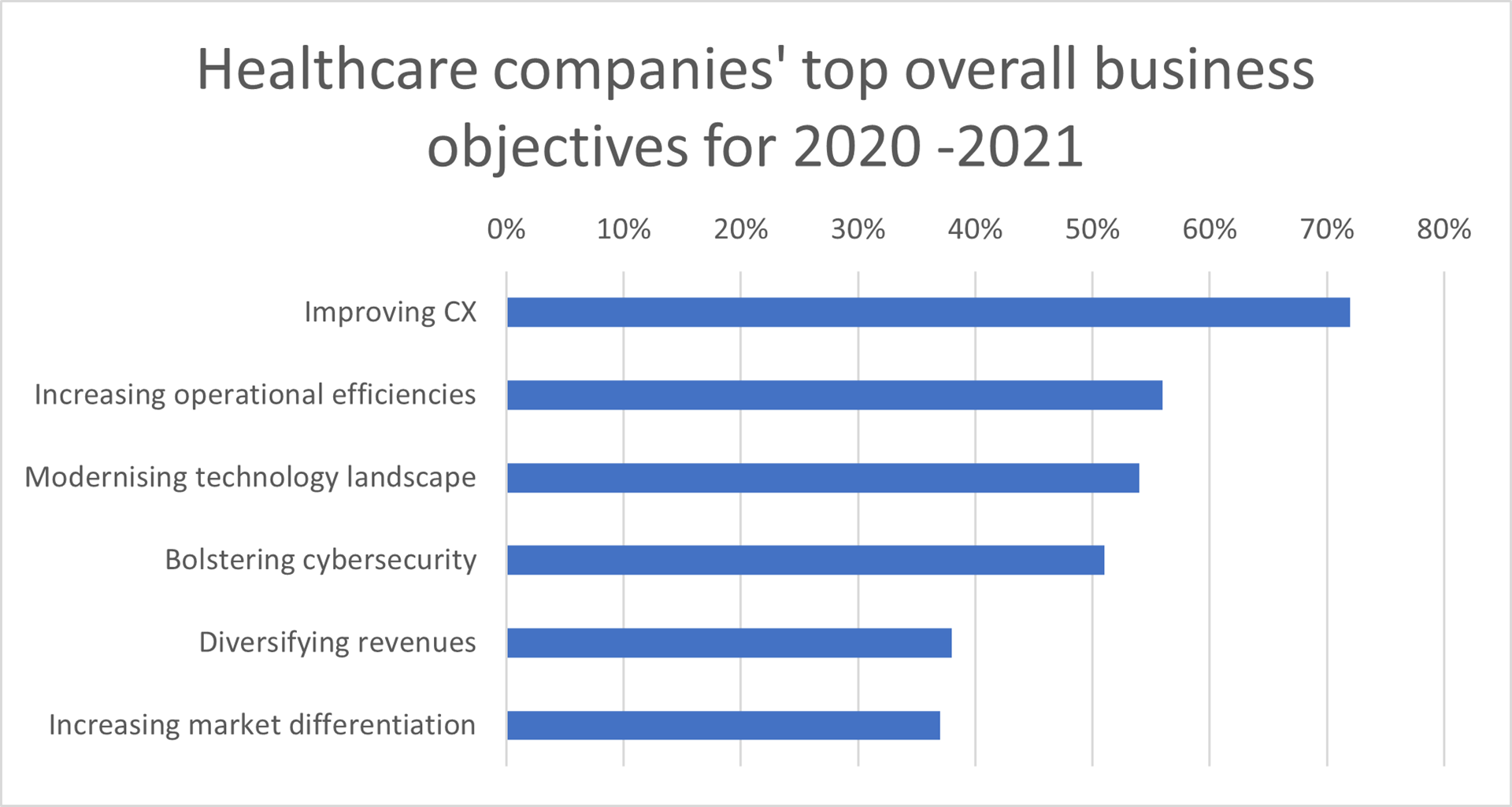

Data: BDO 2020 Healthcare Digital Transformation Survey, Graph: BDO Global

Furthermore, as evident in BDO’s healthcare research, companies in the space are busily trying to adapt to some of the changes in demand that COVID-19 has accelerated. For example, there is an increased focus on improving the customer experience, upgrading operations and digitisation efforts – often to increase operational efficiency.

Decision-makers throughout the space are cognizant of the need for new investments and actively pursuing upgrades. As seen in BDO’s 2021 Healthcare CFO Survey, top business strategies for 2021 focus on digital transformation, product or service expansions and geographic expansion.

Communication Emerges as Early M&A Leader

Communication is one of the core areas where healthcare companies and organisations are looking to build out their offerings. Communication covers interactions with patients, including some healthcare services, such as online booking and online consultations.

Here, as elsewhere in healthcare, technology’s disruptive potential can be likened to what Amazon has done to the brick-and-mortar retail industry.

Instead of visiting your local GP or going to a hospital, patients can enjoy consultations from the comfort of their homes. In addition, thanks to robust communication and the emergence of complementary technology, such as wearables, relevant health data can be shared directly with healthcare professionals. In some instances, prescriptions and next treatment steps can also be handled right then and there.

It makes sense then that CB Insights data shows funding for ‘telehealth’ (services that include healthcare communication) breaking records for the fourth quarter in a row with a combined US$4.95 billion in 2021 Q2.

This has also led to a string of M&A deals involving healthtech companies, SaaS groups, companies in related spaces, and strategic investors.

For instance, healthtech unicorns such as Kry, DocPlanner and Babylon Health focus on delivering communications-related services. All three have undertaken both large funding rounds and M&A to grow their businesses.

Private equity firms are also pursuing deals and raising new funds. One example is Accelmed Partners’ new US$400 million fund for investments in commercial-stage healthtech companies.

Visma, an HG Capital-backed European SMB-focused software Decacorn (companies with a valuation of more than US$10 billion), has made two acquisitions in healthtech in Q2 with its investment in Therapieland and Ecare, aimed at supporting care providers to digitise, collaborate and communicate. The world’s biggest technology companies, including Amazon, Google and Apple, are also making healthtech investments.

The same dynamic applies to companies outside of technology. Walmart’s acquisition of MeMD indicates that the retail giant sees a bright future for healthtech services as part of its offerings.

A prime example of ongoing activity in the SaaS space is Harris, part of Canadian vertical market software group Constellation Software, which continues to add e-health and healthcare software companies to its already impressive portfolio in the vertical. Its latest investments include US-based Ingenious Med and ADL Data Systems, and Belgian ER Express.

Collaboration and Consolidation Moving Through the Gears

While we also see activity in the healthcare collaboration software space, the deal pace is slower. This may be a testament to B2C healthtech currently performing stronger than the B2B segment – in part due to the latter’s more complex nature.

Said differently, creating digital appointment booking and consultation systems may be more straightforward than building out complete collaboration platforms, like a Microsoft Teams-equivalent for healthcare.

The many moving parts and the need to integrate them all into a single solution is challenging. Then add the need for said solution to meet wider legislative frameworks and adhere to all applicable rules, potentially across national or regional borders.

However, as we have seen in other software spaces, including customer relationship management, enterprise resource planning and content management systems, the upsides and potential of expanding service portfolios and building platforms are huge. This applies to both healthtech communication and collaboration solutions.

Consolidation almost invariably leads to increased M&A activity. Companies and strategic investors look to expand market shares and service portfolios through bolt-on acquisitions and mergers with direct competitors.

For example, investors and companies with online consultancy and booking system solutions will be interested in how they can be coupled with the likes of online prescription services to create a one-stop-shop for GPs.

As a result of the dynamics in play, we can expect to see a growth of buy-and-build acquisitions and consolidation moves in the coming years.

All-in-all, mid-market TMT M&A remains very strong, and with yet another industry on the verge of ‘being eaten’, we see no signs of a slowdown but instead expect further growth.