The conundrum of Media valuations in the storm

The conundrum of Media valuations in the storm

The last 18 months have increased valuation complexity in the media sector. Understanding a company’s role in the ever more digitised market and how well positioned it is to take advantage of the recent changes can help both shareholders and investors gain a deeper understanding of valuation drivers.

The last 18 months have increased valuation complexity in the media sector. Understanding a company’s role in the ever more digitised market and how well positioned it is to take advantage of the recent changes can help both shareholders and investors gain a deeper understanding of valuation drivers.

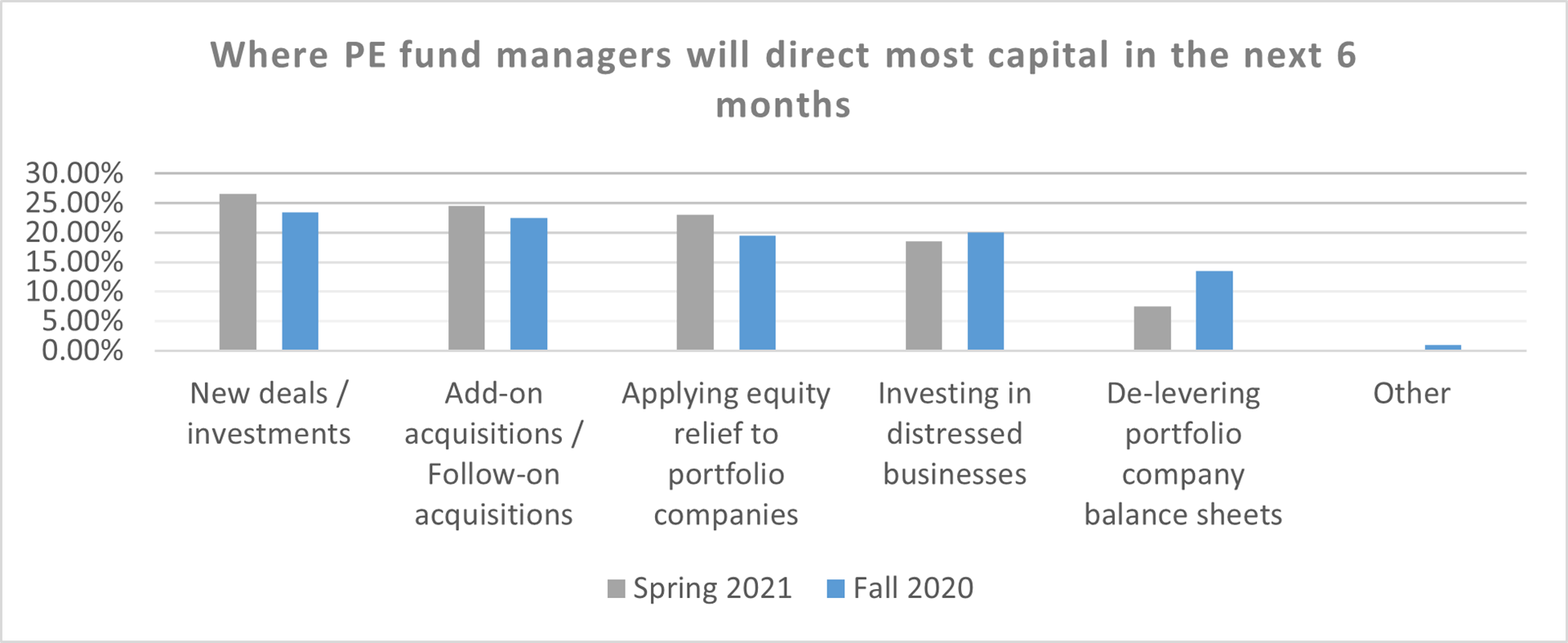

Interest in media companies is growing. In our latest edition of BDO’s Private Capital Pulse survey, investors are showing increased interest in new deals/investments, as set out in the chart below.

Data, Graph: BDO Private Capital Pulse Survey

EBITDA and similar traditional metrics remain part of the foundation for company valuations, with many digital marketing assets trading at 9-13x. However, throughout the sprawling ecosystem of sectors in the media space, defining the value of a media company depends on an array of factors. Some, such as projections for future earnings and performance, have become more challenging due to increased economic and market variability.

Companies and potential investors are tasked with re-examining the valuation process and addressing changes. Simultaneously, heightened digitisation and new technologies are driving evolving business models and approaches throughout media. The cumulative effect of market developments, valuation challenges and heightened uncertainty on M&A processes is akin to a perfect storm.

Thankfully, many of the effects of this storm can be managed by data-centric, high-quality analysis and running clear and focused processes from both sides of a transaction. Shareholders can seek to leverage data to maximise profitability and clearly explain what makes their business stand out from the crowd. Investors can similarly benefit from access to rich analysis to identify prime investment targets and understand how best to work with them to drive growth and ultimately achieve the best return for their outlay.

Digital marketing, as a sector, provides excellent examples of the above in the current market. Many digital marketing businesses will have done exceptionally well during the COVID-period. From the investor perspective, identifying which are likely to push on while others fall away requires a granular, data-driven approach. In assessing this, an investor can develop a deep understanding of the company’s sub-sector and how an investment can help it realise its full potential.

This will then inform the valuation and attractiveness of a company and what an investor is likely to be willing to pay. With a focus on digital marketing, many of the examples and recommendations presented are applicable throughout the media industry.

Media Shows Resilience and Readiness for Growth

BDO’s latest edition of MEDIATalk lays out how media has proven resilient to the impact of COVID-19 and is seeing increased investor interest, as well as continued M&A activity.

As lockdowns end and inoculation rates continue to rise, activity is growing across the media space. Some spaces, such as events and cinemas, are ‘starting from zero’. Others, such as terrestrial TV, are seeing activity jumps while others again, like digital marketing agencies, are looking to continue the momentum built up during the last 18 months or at the very least consolidate their newfound position and market share.

COVID-19 saw many media sub-sectors transition rapidly up the growth trajectory S-curve. The industry had been on the rise steadily up to 2020, but the pandemic period led to a seismic jump in growth. Integration and adoption of new technologies is a core driver of this growth, coupled with consumers being driven to significantly more interaction with the digital world. Digital marketing companies are at the forefront of innovation and creativity when it comes to working with new technology, which is core to their strong performance during COVID-19.

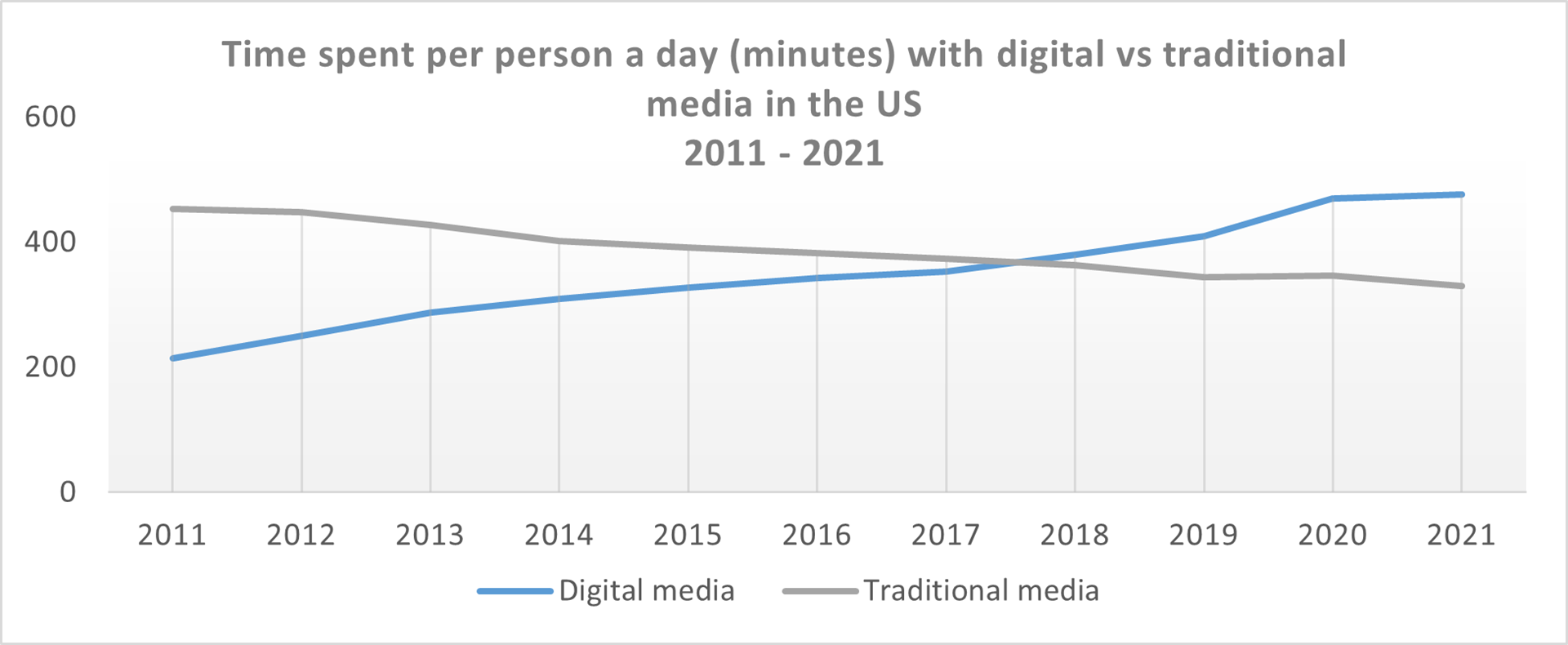

Media companies and investors are, like many others, still in the process of defining the ‘new normal.’ The answer will include the word ‘digital’. Digital media consumption has grown rapidly. Simultaneously, digital solutions are at the core of media companies’ ability to keep improving workflows, streamlining operations, strengthening customer interactions, and increasing profitability. Digital marketing is also now the most active advertising channel, having surpassed traditional channels in many countries. The change is mirrored in media consumption, where digital also tops traditional media channels in time spent per day across many markets (see below).

Data: Statista, Graph: BDO Global

Across the wider sector, from cinemas and events to digital marketing and online media, there are many companies with strong brands and core business structures. This creates opportunities for investors beyond the more youthful high growth businesses catching the eye. However, to survive to the day when profits return, and cash coffers are replenished, some companies may need cash injections for a while longer. The key is to find the right horse to back, then provide funding and careful management through to renewed success.

So, whether a company is building on existing momentum or readying itself for a new reality, there is likely to be a strong case to investigate options in relation to funding and investment. This may well end up resulting in an M&A process. Many investors, including private equity (PE) and venture capital (VC) firms, are currently actively looking to invest in media. Simultaneously, new business models are emerging, such as media and marketing companies that go beyond traditional marketing to provide customers with a broad portfolio of services. These relative newcomers are also looking for opportunities to add further to their offerings to the newly digitised world.

In other words, the prospects for media deals are strong.

This leads us to consider the exact details of how a media company is valued, which has undoubtedly been affected by the last 18 months.

Changes to the Valuation Process

Company valuation includes analysis carried out across customer, employee, company, industry, and macro-economic areas. Some of the central themes and techniques – and how to prepare for a valuation process on the company side – can be found in these BDO guides for companies in the technology industry.

Today, much of what applies to the technology space is transferable to media valuations. This is partly because of changes to media companies’ business models and technology platforms. Revenue models are changing with many investors increasingly prepared to pay premiums for companies with income based on retainers and embedded relationships. This is creating similar, multiple impacts as subscriptions or memberships have had on the technology space.

Multiple revenue streams are also preferable, especially if they offset and perform differently in different market conditions. This helps boost a company’s perceived risk tolerance and robustness.

How media companies have performed during the pandemic is making many rethink their valuation process. This also applies to companies that experienced high growth during this period, with revenue increases of 30 to 50 per cent per year not unusual (and higher for certain digital marketing business). Understanding how sustainable high-growth performance is remains key to any potential investor during an M&A process. To support any valuation having a clear, convincing outlook and plan will be critical. A strong performance during COVID-19 on its own will not suffice. Formulating such plans and outlooks will be critical to all media companies, no matter their performance during COVID-19.

Other areas impacting valuation processes include:

- Cash flow: businesses have been hit differently and are seeing different recovery speeds. Cash flows and cash flow forecasts have changed across the various sub-sectors, with a much greater appreciation of the importance of careful management and planning.

- Financial forecasts: Macro-economic and industry trends have evolved, accelerating historical trends, affecting forecasts which need to address greater degrees of uncertainty.

- Risk factors: An acute change to how a company is affected by risks, including tax regimes, supply chain, cybersecurity, and industry-specific risks, must be addressed.

- Access to appropriately qualified staff: Shortages in expert employees has led to businesses searching far and wide for talent – and considering the right, people-driven, bolt-on deals.

- Comparable deals: Multiples may be distorted, increasing focus on comparable listed entities and their trading multiples.

One core observation is that increased uncertainty surrounds projections and valuations. As a result, a case-by-case strategy for analysis is coming to the fore. In an M&A setting, we simultaneously see changing deal structures, with increased use of earn-outs and deferred payment structures aimed at mitigating uncertainties.

Use Data to Create Clarity

Valuations are not only determined by where a company and industry are today. Most of the focus will be on the future trajectory of both. As previously mentioned, one of the areas where both companies and investors are concentrating efforts and attention is digitisation.

In the post-pandemic reality, examples of digital capabilities helping to increase valuations include:

- End-to-end digital user experience offerings: providing immersive and frictionless digital solutions to tap into the whole customer journey from the acquisition point through to engagement and retention.

- Data and analytics: leveraging first-party or zero-party data and robust data analytics abilities will likely separate winners and losers across the media space. This is doubly true with the erosion and phasing out of third-party tracking, creating opportunities for businesses with unique, digitally-savvy offerings.

- Personalised solutions: traditional “one-to-many“ business and engagement models will likely need to evolve or become extinct, and personalised platforms and capabilities will be critical to engage with consumers to re-capture their advocacy, time, and wallet share.

This mix of capabilities can perhaps be summarised as ‘digital with agility’. Business processes and solutions must shift into a data and digitally driven operating model that enables companies to react quickly to changing circumstances.

Media remains staff intensive or staff reliant. At the same time, reduced operating expenses are needed. Smarter operations and intelligent workflows based on automation, AI, and cloud infrastructure can help streamline operations and manage staff overheads. Digitisation should not necessarily replace but rather augment employees’ creativity, drive, and innovation through new technology.

The importance of data and digitisation extends to M&A and evidencing media companies’ growth stories. While many companies, including in the digital marketing space, are good at using data in certain parts of their business, this may not necessarily extend to processes surrounding a company valuation, sale or growth capital process. Areas that can be, but should not be, missed include:

- Client profitability: at both gross margin and contribution levels to show the true value of key clients.

- Upsell and cross-sell: being able to present clear case studies of how your business has embedded itself with clients providing more services to them where possible.

- Staffing capacity and utilisation: not traditionally a favoured metric due to its perceived Big Brother intrusiveness, it is critical to understanding how staff are and can be leveraged most efficiently.

- Balance sheet metrics: having a clear understanding of the business’s cash flow cycle and how this interacts with the growth being experienced and the mix of clients and services.

The central point is that data and digitisation should be considered core to not just business operations. It should be central to communicating clearly about where a business is at, where it is headed, and how an investment will assist it in reaching its goals. To achieve that, careful attention to and structuring of data across many areas, including financial, industry and customer levels, is pivotal. Furthermore, companies and investors will need to connect these data and insights with broader trends, and their influence on issues like tax, and financial reporting.

In short, keeping track of them all will be a large-scale task. One that we at BDO have had the pleasure of helping both media companies and investors to understand over recent months, leveraging our significant experience in and understanding of the space across our service streams and international network.