Five graphs illustrate why Latin America could see a Tech explosion

Five graphs illustrate why Latin America could see a Tech explosion

Latin America’s technology sector looks primed for rapid growth. Five charts illustrate some of the factors that contribute to the region’s high potential.

Latin America’s technology sector looks primed for rapid growth. Five charts illustrate some of the factors that contribute to the region’s high potential.

Increased innovation, digital transformation, market growth, and rise of a new generation of start-ups looks to be emerging for the technology sector – and market - in Latin America.

As described in the new, second edition of BDO e-books on international technology hubs, the region could be on the cusp of rapid growth. With the right approach, start-ups, companies, and investors can make the most of the coming opportunities. However, grasping the opportunities requires also being aware of the potential challenges, such as different tax setups, R&D benefits, and economic prospects.

In this article, we look at both the opportunities and challenges that might be associated with entering – or increasing your presence in – the Latin American technology space.

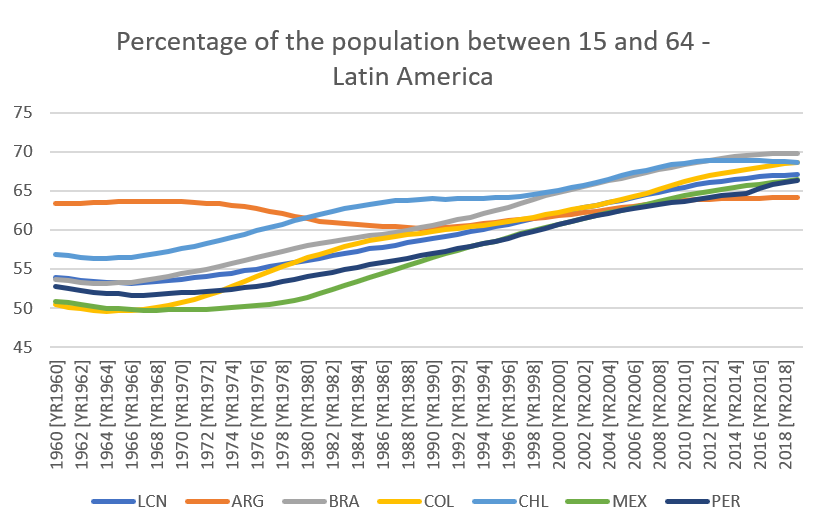

Demographics Point to Growth

The Latin American region is seeing several positive population trends. Especially in relation to the percentage of people between 15 and 64 – often referred to as the working age.

Data: World Bank. Graph: BDO Global.

In the “Latin America and the Caribbean 2030” report, by the Inter-American Development Bank and Atlantic Council see the trend continue.

“For the region as a whole, the working-age population will increase proportionally until approximately 2025. A favourable demographic “window” will remain open into the 2030s, but will shut in the 2040s,” the report says.

Potential benefits of a large percentage of the population in ages where they are likely at work or undertaking advanced education includes that it can increase the need for work-related products and services. The same can apply to financial services, which is underscored by the rise of fintech and financial service technology in the region.

Both companies and investors that we speak to about establishing a foothold in Latin America often mention the potential for services and products to reach an extensive population as one of their main motivations.

However, which areas will be best suited for investment will depend on your services and strategy. Some other factors to consider include the perceived stability of the economy. Chile, for example, has a smaller economic footprint than a country like Argentina, but tends towards better perception of safety for investments. On the other hand, many Argentinians are unbanked, leading to potential for certain kinds of fintech investment.

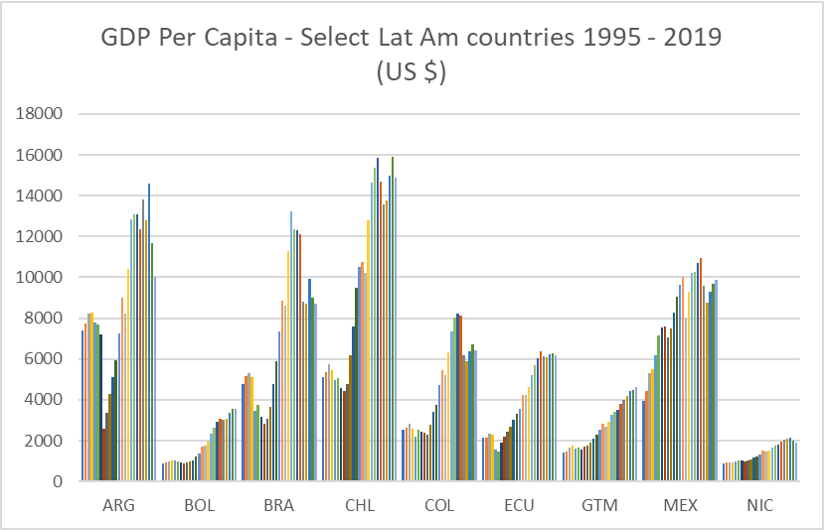

Return of Growing GDP Figures?

Covid-19 has thrown a spanner into the works of pretty much all existing projections for growth and capital gains. This is part of the reason why we here at BDO have developed the RETHINK framework to help companies react to uncertainty, build up resilience and realise their full potential.

Latin America has been struck hard by the economic fall-out from Covid-19. The IMF predict that the region could see a recession. Stark warnings indeed, and there can be little doubt that companies and countries are facing hard times, but they may be able to take comfort in two facts:

- Latin America is by no means the only region to be hit hard by Covid

- Historical GDP figures for the main markets tend to show stable growth

Data: World Bank. Graph: BDO Global

While it is an oversimplification to equate growing GDP with growing market strength and purchasing power, it is a strong indication. According to the World Bank standard for income categorization, many countries in the region now reside in the higher-middle-income range. Furthermore, the region has high urbanization ratios. The conclusion is that people in Latin America often live in urban middle-class environments traditionally defined by aspirational consumption patterns.

Said differently, there is a strong purchasing power in the population – including for technology-driven solutions and products.

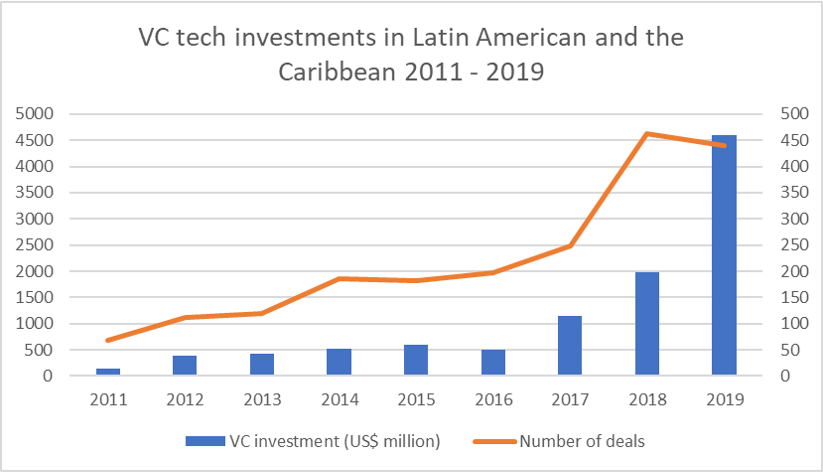

Growing Investments Continue to Rise

Investment data for Latin America shows clear trends of growth. The Economic Commission for Latin America and the Caribbean’s (ECLAC) studys ‘Foreign Direct Investment in Latin America and the Caribbean 2019’, showed direct investment inflows were up by 13.2% year-on-year.

Data: LAVCA. Graph: BDO Global

Latin America Venture Capital Association’s (LAVCA) Annual Review of Tech Investment in Latin America for 2019 also showed increased investment with deal totals reaching $4.6B in 2019, more than double the $1.9B in 2018. 37% of investments were made by co-investors involving at least one Latin American and one global investor, indicating significant cross-border involvement. Proptech, HR tech, CRM, Biotech and SaaS were the fastest growing sectors by deal count.

VC fundraising in the area also set a record ($1.08 billion), and there were 14 deals with a +$50 million value tag. Importantly, all but a few were expansion stage deals, indicating an increasing maturity level of technology companies in the region.

The growth in maturity level of companies tends to create positive feedback loops that include more experienced mentor, maturing investment ecosystems and increased growth potential. Furthermore activity like Softbank’s $5 billion fund focused on South America and activety of respected global VCs like Andreessen Horowitz, Sequoia Capital and Accel Partners, add a stamp of approval which others will likely follow.

However, the current climate during the pandemic has proven difficult to navigate for many companies in the region. Supporting existing companies and shying away from new deals is hampering smaller start-up ecosystems, such as those emerging in Peru, Ecuador, and Bolivia. For all, extending runways and optimizing cash flows are the order of the day. As elsewhere, we may see a bounce-back after the fallout.

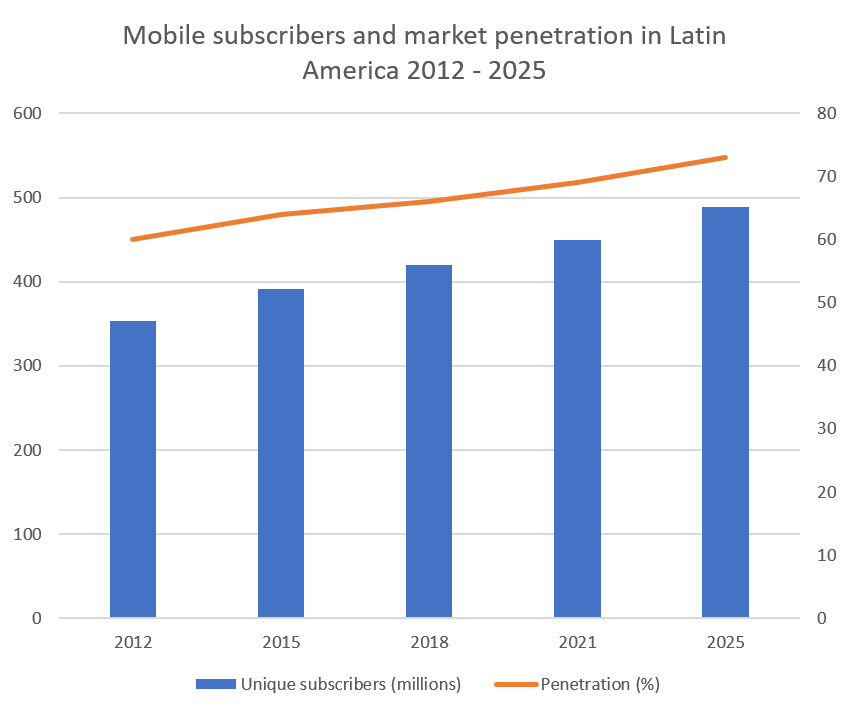

Expansive mobile Internet connectivity

You would be hard pressed to find technology companies who would not agree that internet connectivity is essential for their success. Latin America has, as a region, been making great strides in improving connectivity. Seventy-three percent of South America’s population now has access to the Internet, often through a mobile device.

Data: GSMA. Graph: BDO Global

Analysis from GSMA, which represents the interests of more than 750 mobile operators across the world, indicates that connection speeds are also increasing. In 2018, 4G connections surpassed 3G connections by more than 27 million. We expect to see early roll-out of 5G technology in Mexico (2020), Brazil (2021), and Chile (2022), followed by elsewhere in the region. GSMA predicts 5G connections will reach 58 million by 2025, as well as 1.3 billion IoT connections.

However, it remains unclear about the spread of 5G and there may be infrastructure issues to take into consideration. The same applies to the need for reworking existing regulations and incorporating new initiatives to help support growth. A keen eye on – and understanding of – the situation is a must for tech companies.

Latin America’s connected consumers are make Brazilians the fifth-largest population of Internet users[NC1] worldwide. Along with Mexico, it is also one of the top global markets for Facebook products, including Facebook, Facebook Messenger, Instagram, and WhatsApp. Latin Americans’ connectedness is mirrored by big tech’s investments in the area. Over the last couple of years Amazon has launched a huge Amazon Prime investment for Brazil, Uber has pointed to Latin America as one of the premier markets in the world. Instagram launched a unique new feature, solely in Brazil.

The exemplary rise of FinTech

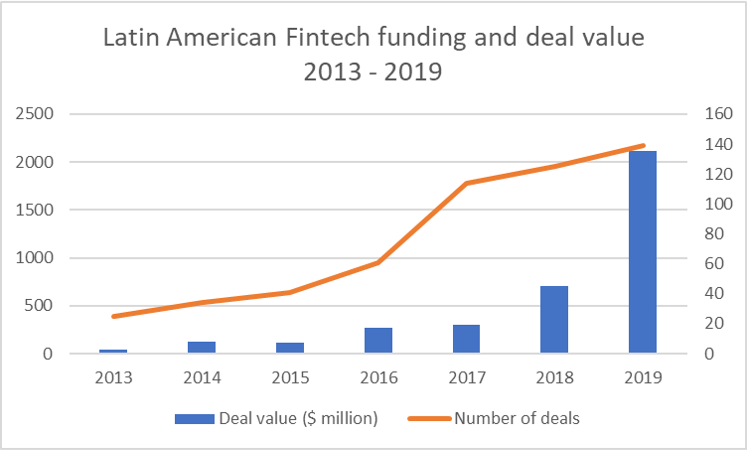

One of the big winners in this area is fintech. Exemplifying some of the changes that we can see spread throughout other areas. In six short years, Latin America fintech funding has grown from less than $50M to top $2.1B across 139 deals, CB Insights reports.

Data: CB Insights. Graph: BDO Global

The rise in investment indicates how banks' competitors no longer count other banks, but also technology companies competing via lower cost and greater efficiency. Throughout the region, digital banks appear and grow rapidly, virtual wallets are expanding, insurance companies are focusing on digital channels, and traditional companies have a cost structure and business model that places them at a crossroads; transform or disappear.

As illustrated by a recent report on Latin American banking by Mastercard, there is a need for incumbents to rethink toward viewing the experience as ‘Banking-as-a-Service’ in order to stay relevant. The realignment includes critical, central themes such as:

- Expanding service lines: look at related verticals where you can create traction and increase revenue streams.

- Leverage AI: Stay personal while lowering expenses through AI-powered digital tools like chatbots and virtual assistants.

- Go toward omni-channel: Central app-driven and platform driven interaction with customers across all devices.

- Create value by using data: Generate more income and new revenue streams by analysing and innovating based on data.

- Build trust: ensure that customers feel trust and that their interactions with your company are safe.

These are by no means solely issues for banks, as companies throughout industries in all Latin American countries – and beyond – are facing similar competition and need to streamline operations. This is part of why we can expect to see similar growth in other areas, such as RPA, Analytics, Artificial Intelligence and Machine learning, biometrics, e-learning, electronic healthcare, blockchain, and robotics, to mention but a few.

BDO has a wide network throughout Latin America. Contact us with any inquiry you may have – about the subject matter of this article or anything else - and we will help you get in touch with the relevant of offices and experts.